$2 Billion in Impact

...and counting

Capital Impact Partners 2014 Annual Report

Terry Simonette

President & CEO

CAPITAL IMPACT PARTNERS

2014 was a milestone year for Capital Impact Partners.

Among our many achievements is the fact that we crossed the $2 billion line in loan disbursements to projects in underserved communities. Even more impressive is that, while it took 25 years to reach the $1 billion mark, it only took five to reach our second billion. Behind these numbers is what matters most - our ability to work with partners and borrowers and touch the lives of those most in need.

In this report, you will meet Devon, who recently graduated from the Henry Ford Academy in Detroit and is now attending the College for Creative Studies. You will experience a day in the life of one our Green House homes and witness how this innovative model is helping its residents age with dignity. You will see how San Francisco’s South of Market Health Center is serving as the safety net for patients like Ray Sullivan and Susan Gouveia, who would otherwise have gone without health care.

Confidence in our ability to create impact was again recognized in expanded partnerships with investors like JPMorgan Chase as well as a number of awards given through the U.S. Department of Treasury’s Community Development Financial Institutions Fund. I invite you to read our interview with Aaron Seybert at JPMorgan Chase and see our award details in the following pages.

We also continued to demonstrate our ability to take small innovative models and scale them nationally. Since 2010, our Village-to-Village Network—which allows elders to age in their homes with community support—has increased 200 percent, to 141 villages across 41 states, serving 25,000 seniors. With approximately 100 villages in the development stage, we felt that the organization was well-positioned to transition to an independent group of village leaders for ongoing management.Behind these numbers is what matters most, our ability to work with partners and borrowers and touch the lives of those most in need.

Lastly, given the dedication to our mission both internally and externally, I am particularly proud that Capital Impact was named a Top Workplace by The Washington Post.

Through our ingenuity and strategic financing, Capital Impact remains a leader in improving the lives of low-income individuals and the communities in which they live. And, as our 2020 strategy begins to take shape, I am excited about the possibilities ahead of us.

The opportunity to build strong, vibrant communities of opportunity in underserved areas is limited only by our imagination.

This Is 30 Years Of Impact

We see communities as a system – a unique collection of people, businesses, products, services and infrastructure that must reinforce each other for residents to prosper. A community’s true strength is only realized when its sectors interweave to make a strong fabric of integrated resources that build off of each other and empower individuals to improve their lives and livelihoods.

As a leading Community Development Financial Institution, we provide the right investment to catalyze that potential in neighborhoods across the country. We invite you to view our newest infographic visualizing what our 30 years of impact looks like.

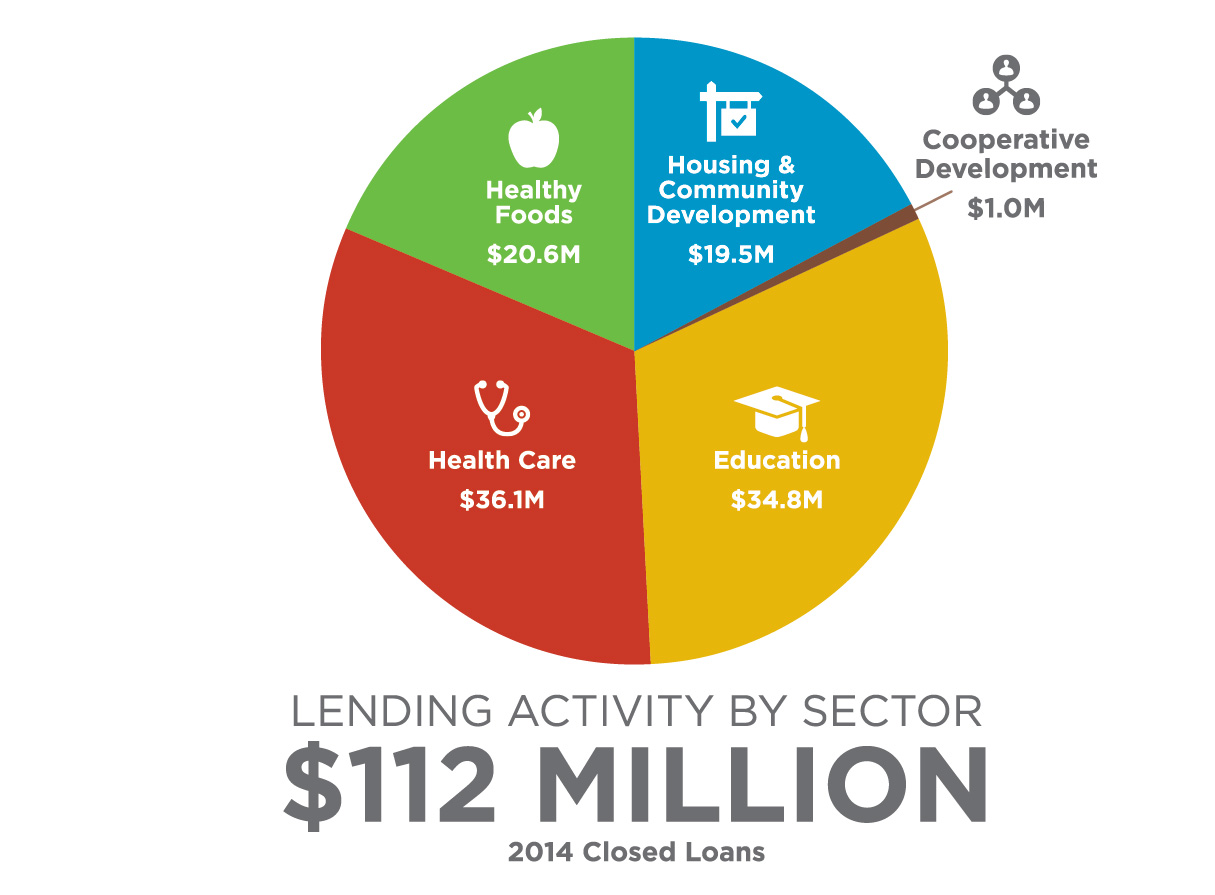

Lending For Impact

Scott Sporte

Chief Lending Officer

CAPITAL IMPACT PARTNERS

Although lending is a primary activity at Capital Impact Partners, it is a means to an end: we use capital as a tool to effect positive change in underserved communities across the country.

When we consider a new loan, the first question we ask is whether it will create jobs or provide needed services or opportunities for the people who live in the communities we serve. It is only after we have ascertained whether the financing request achieves a positive social objective that we proceed to assessing the project’s financial viability.

The projects we finance do not fit a conventional mold, and many of their fundamentals do not fit within the guidelines of regulated financial institutions. Each of our transactions is different and each requires our staff to understand the intricacies of layered structures, to utilize creative approaches to risk mitigation and to provide technical assistance to our borrowers.We have demonstrated year in and year out that we are able to provide capital at a consistent level to achieve significant community impacts

We saw this in 2014 through the construction of grocery stores to combat food deserts in California and Michigan; in the expansion of community health centers in New York and North Carolina; in new educational choices in Massachusetts and Florida; and in the skilled nursing care provided in homelike settings in Minnesota and Colorado.

This “artisanal” approach to lending takes time and patience, but we have demonstrated year in and year out that we are able to provide capital at a consistent level to achieve significant community impacts.

We consider Capital Impact to be more than just a lender; to construct grocery stores in food deserts in California and Michigan; to expand community health centers in New York and North Carolina; to provide educational choices for young students in Massachusetts and Florida; and to increase opportunities for elders to receive skilled nursing care in warm, homelike settings in Minnesota and Colorado.

The loans we closed in 2014 benefit 4.5 million people nationwide—including more than 500,000 health center patients and 15,000 students—and created in excess of 1,200 jobs.

We sharpened our focus in Detroit, receiving a substantial investment from JPMorgan Chase to expand our work increasing population density, building walkable communities and expanding services in neighborhoods in new corners of the city. In the process, we helped to preserve the city’s culture by funding a number of projects that saved historic properties.

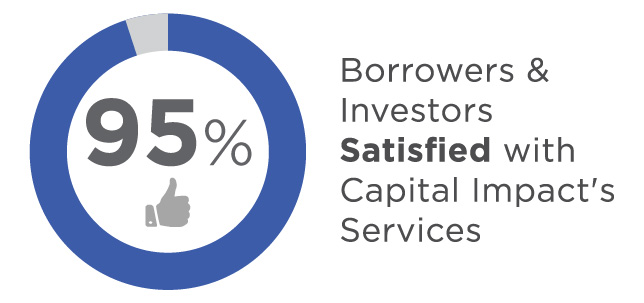

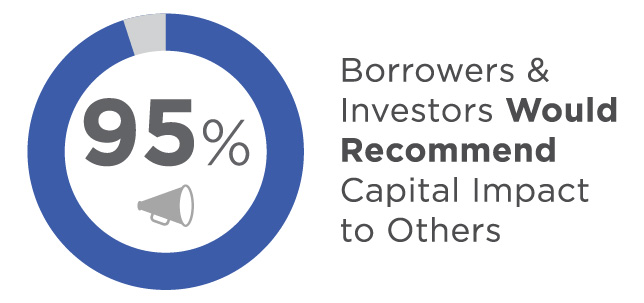

As we did all this, we polled our stakeholders about their experience working with us. More than 95 percent of our borrowers and investors told us they were satisfied with our services, and another 95 percent said that they would recommend Capital Impact Partners to others. I am as proud of earning your trust and respect as I am of the results we have achieved in the neighborhoods where we work.

As you read the following stories, please join with me in celebrating the accomplishments we have achieved with our partners and borrowers. Looking forward, I have to say that I am incredibly excited about the opportunities lying before us as we seek new ways to increase our impact in the communities we serve.

2014 Impact Highlights

![]()

$112 Million Closed

![]()

665,000 served

![]()

1200 jobs created

![]()

Education:

15K students

![]()

Healthcare:

500,000 patients

![]()

Healthy Food:

75K people

Throughout 2014, Capital Impact Partners and our staff were honored with a number of awards recognizing our leadership in the community development space.

The Washington Post named Capital Impact among its Top Workplaces for 2014. The Top Workplaces awardees were determined through independent surveys conducted by WorkplaceDynamics, LLP. Factors contributing to the award included our dynamic work environment, flexible work schedule, company-wide volunteer days, employee nominated funding for local nonprofit institutions and an excellent benefits package. Each member of Capital Impact is guided by the institutional core values of cooperation, leadership, commitment, diversity, innovation and trust.

Amy Sue Leavens, Capital Impact's general counsel and corporate secretary, was honored with the Corporate Counsel Award for Community Service. The award was presented by the Washington Metropolitan Area Corporate Counsel Association, the leading regional bar association. These awards honor the work of the region’s leading in-house legal practitioners and departments.

The Community Development Financial Institutions Fund – a department of the U.S. Treasury - promotes economic revitalization in distressed communities throughout the United States by providing financial assistance to CDFIs. Capital Impact was awarded a number of grants including:

- $55 million in long-term capital through the CDFI Bond Guarantee Program. This federally-guaranteed program allows us to provide borrowers with fixed-rate, long-term financing that helps support long-term financial stability and control facility costs.

- $43 million in New Markets Tax Credit allocations. We are one of just 87 organizations to receive a financial award through this program, which is designed to help CDFI’s save and create jobs and spur economic development in distressed communities.

- $2 million Financial Assistance (FA) award to sustain and expand our financial products and services, plus a $2 million Healthy Food Financing Initiative Financial Assistance award (HFFI FA) to expand our healthy food-focused financing activities. We are one of only 12 CDFI’s out of 152 who received both FA and HFFI FA award grants.

From organizational features to stories about our work revitalizing Detroit, supporting affordable homeownership and demonstrating innovation in aging, our impact was featured in a number of national news outlets.

Arlington County Economic Development News

Capital Impact Partners: Using Social Innovation for Success

Capital Impact Partners was named a Top Workplace by The Washington Post in June 2014. This article explains what makes Capital Impact Partners a Top Workplace and why our mission drives our staff.

Read More

The Washington Post

JPMorgan is betting $100 million on Detroit. Can it leverage a lot more?

The Washington Post featured JPMorgan Chase’s work with Capital Impact Partners and Invest Detroit to revitalize Detroit by harnessing private capital. Our experience and cooperative approach are critical to bridging the gap between national and local institutions to create social impact. This article helps illustrate the work we are doing together in Detroit to help make it a strong, vibrant community once again.

Read More

The Detroit News

Detroit’s Growth Must be Inclusive

In this op-ed, Capital Impact’s Bradford Frost takes on the complicated subject of how to ensure that the revitalization of Detroit includes those of all races and incomes. In this piece he argues that “[i]nclusive growth starts by arguing for strategic investments in job-rich and high-density centers that connect Detroiters across the city to genuine economic mobility pathways… [and] provide low-income and disadvantaged residents equal access to quality homes, safe and vibrant districts, good jobs, and worthwhile educational supports.”

Read More

The Hill

Capital Magnet Fund Creates “bang for the buck” In Affordable Housing

The Capital Magnet Fund is a valuable program created by the U.S. Treasury that leverages private capital to support affordable housing and job creation in underserved communities. Unfortunately, there is an uphill fight in Congress to keep this effort funded. Capital Impact’s CEO, Terry Simonette, joined with the CEOs of our partner Community Development Financial Institutions in this op-ed making the case for why the Capital Magnet Fund deserves support.

Read More

The Detroit Free Press

JPMorgan Chase Money Helps Midtown Project

As 2014 came to an end, Capital Impact closed the first loan through its JPMorgan Chase supported Detroit Neighborhoods Fund to provide financing for Rainer Court. Get a behind-the-scenes look at this deal and see how PK Development Group will begin renovation of this 1920s building in Midtown Detroit, creating market-rate housing and retail space that will attract students and young professionals back to the city’s core.

Read More

The New York Times

The Green House Effect: Homes for the Elderly to Thrive

This personal health column seeks to answer the question: “For those who lack financial resources to pay for round-the-clock professional care at home, is the sterile, hospital-like environment of a nursing home the only option left?” With Capital Impact’s Green House model, that answer is no. Learn more about how we are working with Dr. Bill Thomas to revolutionize care for the nation’s elderly.

Read More

Entrepreneur Magazine

How the First Lady Helped Small Grocery Businesses Reduce “Food Deserts” in California

Michelle Obama helped launch Capital Impact's California Freshworks Fund in 2011, highlighting the need for financing inner-city grocery markets in order to bring affordable, healthy options to “food deserts”—urban areas where it can be difficult to acquire find fresh food and produce. This feature in Entrepreneur looks at our impact in creating access to healthy foods for those who need it most.

Read More

What Counts: Harnessing Data for America’s Communities

“The Transformative Power of Shared Data”

Produced by the Federal Reserve Bank of San Francisco and the Urban Institute, this book brings together authors from a variety of backgrounds to examine innovative and strategic uses of data that can drive impact in underserved communities. Chapter three highlights Capital Impact’s HomeKeeper Application, which not only helps practitioners manage the day-to-day tasks of running an affordable home-ownership program but also answers key questions about the long-term social impact of these programs.

Read More

Innovation Fuels Financial Strength

Ellis Carr

Chief Financial Officer

CAPITAL IMPACT PARTNERS

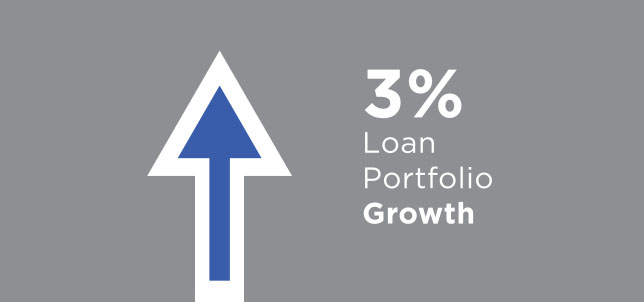

Capital Impact ended 2014 in one of its strongest financial positions to date as both total net assets and unrestricted net assets increased by $8.1 million and $5.3 million respectively.

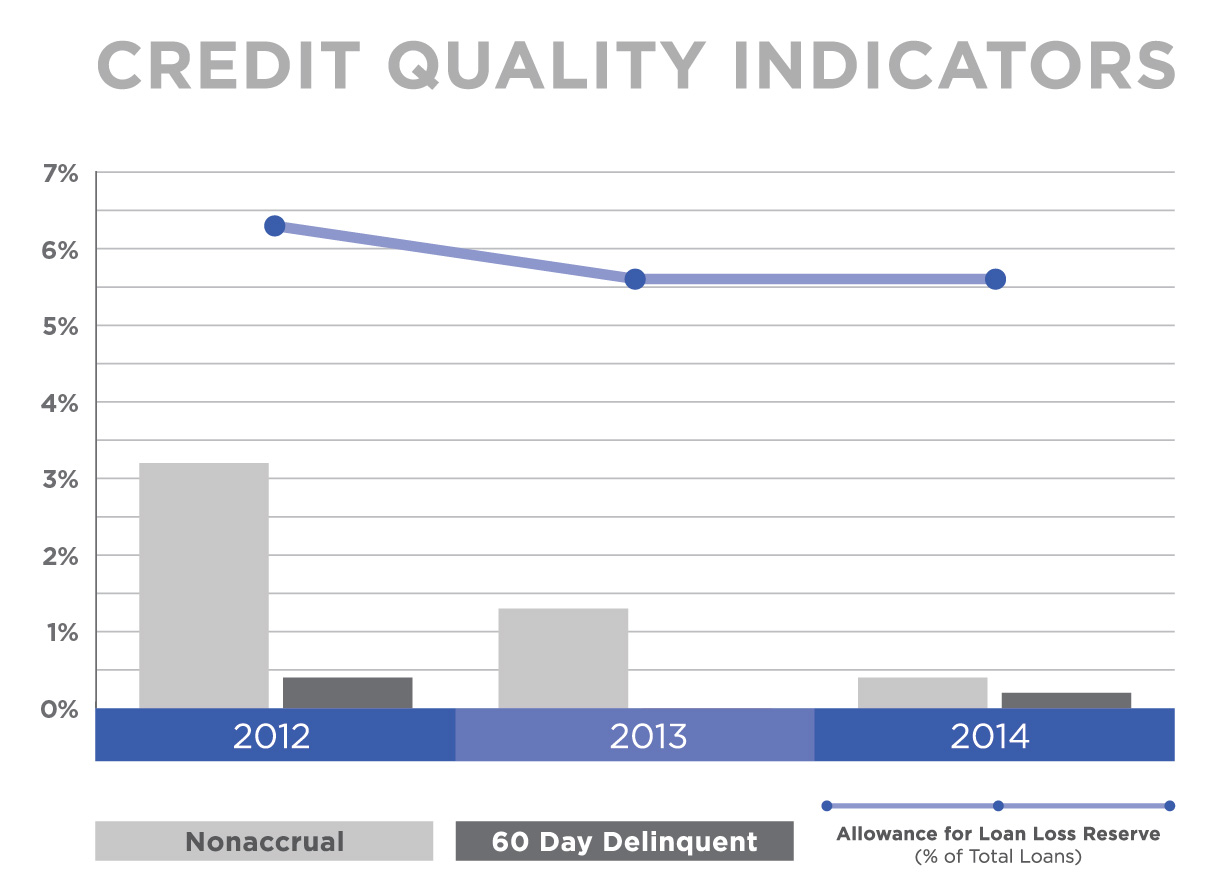

Our financial results were driven in large part by our lending activities. We ended 2014 with $112 million in loan closings and our credit quality remained strong as we closed the year with a delinquency rate of just 0.2%. The 2014 volume and portfolio statistics highlight a few important themes for Capital Impact and the industry:

- Consistency in loan demand year over year demonstrates that organizations like Capital Impact can provide critical “gap” financing to businesses across the country. It also shows how, through effective collaboration with a number of our partners, we can create products and programs that are absorbed in the markets we serve.

- Our portfolio, like those of many of our colleagues, further demonstrates that lending in low-income communities doesn’t translate into additional portfolio credit risk. In fact, our portfolio performance is on par or superior to the performance of conventional loan portfolios.

- Demand for capital in our markets continues to outstrip supply. The needs in the communities we serve continue to evolve, and flexible, consistent capital is needed for these communities to thrive.

Recently, we became a member of the Federal Home Loan Bank of Atlanta and were successful in raising capital through the United States Treasury-sponsored Bond Guarantee Program. Both of these efforts will provide us with the additional flexibility needed to support medium- and long-term projects across asset classes and our geographic footprint.Our portfolio...demonstrates that lending in low-income communities doesn’t translate into additional portfolio credit risk. In fact, our portfolio performance is on par or superior to the performance of conventional loan portfolios.

We also continue to improve our financial health and sustainability through investment in our systems and infrastructure. We made great strides in advancing the multi-year effort launched in 2012 to upgrade our core systems and related processes. As a result, the increased efficiency we are seeing is enhancing the agility of our operating functions and supporting the ability to scale our efforts and better nurture our communities.

Capital Impact Partners and Subsidiaries

Consolidated Statements of Financial Position

2014 (AS OF DECEMBER 31) AND 2013 |

||

| Assets ($ Millions) | 2014 | 2013 |

| Cash and cash equivalents - unrestricted | $22,973,465 | $16,824,376 |

| Cash and cash equivalents - restricted | 39,260,027 | 35,529,139 |

| Accounts and interest receivable | 1,990,401 | 2,559,694 |

| Contributions receivable | 12,296,545 | 7,174,778 |

| Investments | 4,754,555 | 4,623,745 |

| Investment in joint venture | 2,660,793 | 2,661,129 |

| Loans receivable | 164,914,807 | 159,897,403 |

| Less: allowance for loan losses | (9,177,796) | (8,915,755) |

| Loans receivable, net | 155,737,011 | 150,981,648 |

| Loans receivable - subsidiaries | 35,421,220 | 36,709,530 |

| Other real estate owned, net of valuation allowance of $0 in 2014 and 2013 | - | 394,929 |

| Other assets | 2,715,301 | 3,256,266 |

| Total assets | $277,809,318 | $260,715,234 |

| Liabilities and Net Assets | ||

| Liabilities | ||

| Accounts payable and accrued expenses | $4,028,078 | $2,918,871 |

| Revolving line of credit | 24,950,000 | 21,000,000 |

| Notes payable | 67,637,569 | 62,363,844 |

| Subordinated debt | 8,218,000 | 8,218,000 |

| Notes payable - subsidiaries | 35,436,546 | 36,729,152 |

| Total liabilities | 140,270,193 | 131,229,867 |

| Net Assets | ||

| Unrestricted | 84,554,160 | 79,213,421 |

| Temporarily restricted | 51,497,490 | 48,784,471 |

| Permanently restricted | 1,487,475 | 1,487,475 |

| Total net assets | 137,539,125 | 129,485,367 |

| Total liabilities and net assets | $277,809,318 | $260,715,234 |

Key Performance Indicators

| TOTAL DISBURSEMENTS ($ Millions) | |||||||

| 2012 | 2013 | 2014 | |||||

| On Balance Sheet | 62.4 | 58.8 | 64.6 | ||||

| Investor Portfolio | 71.1 | 105.1 | 136.7 | ||||

| Total All | 124.0 | 106.6 | 99.4 | ||||

| TOTAL LOANS OUTSTANDING ($ Millions) | |||||||

| 2012 | 2013 | 2014 | |||||

| On Balance Sheet | 144.0 | 159.9 | 164.9 | ||||

| Investor Portfolio | 111.5 | 161.7 | 298.8 | ||||

| Total All | 930.6 | 912.4 | 891.0 | ||||

| CREDIT QUALITY | |||||||

| 2012 | 2013 | 2014 | |||||

| Nonaccrual | 3.2% | 1.3% | 0.4% | ||||

| 30 Day Delinquent | 0.2% | 0.3% | 0.1% | ||||

| 60 Day Delinquent | 0.4% | 0.2% | 0.2% | ||||

| Allowance for Loan Loss Reserve (% of Total Loans) | 6.3% | 5.6% | 5.5% | ||||

THOMAS BLEDSOE

Housing Partnership Network

JANIS HERSHKOWITZ

PRL, Inc.

ELI KENNEDY

Red Bird Advanced Learning

ROSEMARY MAHONEY

SENIOR ADVISOR

Cometrics

RAY MONCRIEF

Kentucky Highlands Investment Corporation

DANA PANCRAZI

VICE PRESIDENT, CAPITAL MARKETS

F.B. Heron Foundation

MARY ANN ROTHAM

Council of New York Cooperatives and Condominiums

CHARLES E. SNYDER

National Cooperative Bank

DAN VARNER

Excellent Schools Detroit

THOMAS W. WALSH

PricewaterhouseCoopers LLP

JUDY ZIEWACZ

State of Wisconsin, Office of Energy Independence