Driving Change by Investing in an Equitable Future

For too long, systemic racism and disinvestment have prevented communities of color from economic mobility and wealth creation. That’s why we’re part of a financial movement to eliminate racial disparities and uplift community-led solutions so everyone can flourish. As you look to grow, build wealth, and invest in your community, we’re your partner on the road to actualizing your dreams.

Are You Looking for a Loan?

We provide flexible and affordable capital to nonprofits, entrepreneurs, and other organizations working in underestimated markets. Our loans are tailored to the communities we serve so you can achieve your community development goals while remaining true to their values and vision.

Need A Small Business Investment?

We provide venture debt, profit-sharing agreements, and direct equity investments into growth-stage enterprises and small businesses with the goal of supporting organizations focused on creating economic opportunities; reducing food insecurity; improving community health; and growing cooperatives.

Join a Program

From our Equitable Development Initiative for real estate developers of color to our Co-op Innovation Awards for cooperative models, our programs will give you the opportunity to learn from experts, grow your networks, and create long-term success for yourself and your community.

Invest in Us

We’re investing in high-potential communities. You can too. Our Capital Impact Investment Note provides an opportunity for social impact investors who want to make a social and financial impact for communities nationwide while earning a return on that investment.

Capital Impact Is Now Part of Momentus Capital

Capital Impact is now part of the Momentus Capital family of organizations. Rooted in social mission, we are driven to ensure local leaders have access to the capital and opportunities they deserve. We support locally-led solutions to build healthy, inclusive, and equitable communities through a continuum of lending, impact investments, training programs, and technology programs.

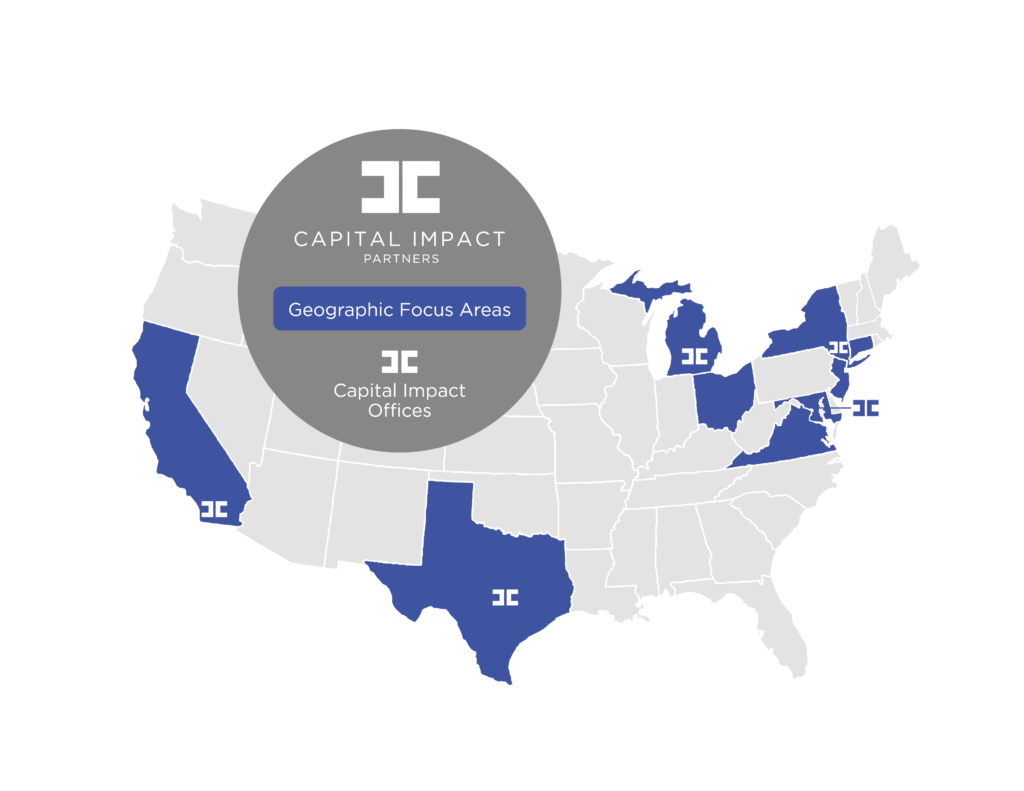

Places We Serve

Standing shoulder-to-shoulder with communities, we work together to create programs that address the needs of the people we partner with. We start by listening carefully to locals, and then we co-create financial services and programs to build on community strengths. Taking a “place-based” approach to investing in communities allows us to foster deep connections with people that help us learn more about their community. Together, we create new pathways to support self-determination and locally-led visions of equity, access, and opportunity.

Behind the Scenes: Building Communities Of Opportunity

As a mission-driven community development financial institution we work tirelessly to ensure good projects often overlooked by traditional financial institutions get the investments they need. Go with us behind the scenes to see how we support social impact projects that create equity, opportunity, and inclusiveness.

STORIES OF IMPACT

Building communities through equitable, affordable housing

Building communities through equitable, affordable housing

When Ronnie and his neighbors learned that their apartment building was sold, they needed local partners to help find a way for them to remain in the neighborhood many had lived and raised kids in for decades. Through equitable and affordable housing solutions, Capital Impact is helping Ronnie and others create stable and healthy communities.

Meet Ronnie and others applying innovative mission-driven solutions to today’s housing crisis.

Transforming health care to meet

today’s needs

While health centers and clinics serve millions of patients, there are still many who are unable to make it to those facilities. OLE Health is bridging that gap by taking its services on the road to meet patients where they are. The result: more equitable access to quality health care for more people.

How One + One is Greater than Two for Underinvested Neighborhoods

As a parent, Diana has a lot to manage among her three children. Fortunately, she discovered a unique opportunity to find a good school and quality health care all in the same place. Stories like this are becoming more common as facilities bring together – or “co-locate” – important services that are vital to healthy communities.