Financing that Supports Connections

By Scott Sporte, Chief Lending Officer

At Capital Impact Partners we put money to work, focusing our efforts on the best ways to use dollars to achieve powerful outcomes. Our lending work at Capital Impact Partners in 2015 increased more than 17 percent above our 2014 level—a success that we celebrate in the present as we look ahead to new levels of accomplishment. This level of lending volume is a source of strength as it supports our organization financially while simultaneously reinforcing communities with increased access to critical housing, services and employment opportunities.

The new Michigan Good Food Fund uses financing to increase equitable access to fresh, healthy food. The Fund focuses on reducing food deserts in cities like Detroit and Flint as well as rural areas north of the Mackinac Bridge. It also supports producers of locally grown fruits and vegetables as entrepreneurs and employers.

Our new Age Strong Investment Fund, developed in partnership with the Calvert Foundation, AARP and AARP Foundation, connects the burgeoning world of impact investing with high impact organizations to provide needed services to low-income people aged 50 and up. With Age Strong, an investment as small as $20 that could be quietly earning interest in a bank is instead put to work constructing housing and providing access to health care for very low-income seniors in rural Colorado. That investment is also helping to eliminate a Philadelphia food desert so that closer proximity to food and community services enables more seniors to remain in their homes as they age.

We have also put our shoulder to the wheel in partnership with the Low Income Investment Fund (LIIF) and The Reinvestment Fund (TRF) to utilize the CDFI Bond Guarantee Program. This program benefits a KIPP school in Camden, New Jersey that constructed a new school for more than 1,000 pre-K through 8th grade students. This school provides high-quality educational options for neighborhoods whose traditional public schools are closing.

In Detroit, projects in the Woodward Corridor Investment Fund and Detroit Neighborhoods Fund began opening their doors to people from a mix of income levels, using our lending as a tool to transform vacant, blighted buildings into vibrant homes near transportation and services for existing and new Detroit residents.

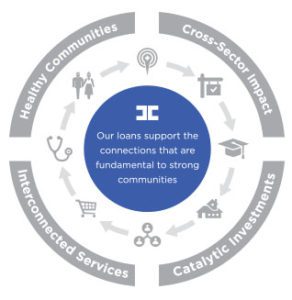

Our entire annual report celebrates those accomplishments and their powerful impact on communities as we simultaneously look ahead to the next five years. Our new lending strategy intends to make money work harder, achieving even deeper levels of impact in and across communities.

We accomplished much in 2015 and know that our diligent effort will lead to even more in the years to come. We are grateful to our partners and thank them for joining us as we look ahead to 2020.

[dcwsb inline=”true”]