Building a Foundation of Equity,

Opportunity and Inclusiveness

ELLIS CARR

PRESIDENT & CEO

CAPITAL IMPACT PARTNERS

As Capital Impact’s new CEO, I am incredibly excited to take this opportunity to both look back at 2015 and to expound on our new five-year vision to 2020.

Over the past year, we continued to build upon the organization’s strong financial position, deep partnerships, and innovative product development. We provided ongoing leadership in the health care space, helped a number of charter schools expand their educational offerings, and saw several of our projects come online across Detroit. We also launched two new lending initiatives that will expand access to healthy foods and support age-friendly communities.

At the same time, two of our long-time programs saw fresh beginnings. After working to build and scale the Green House model for dignified long-term care and the Cornerstone Partnership to expand affordable housing, those initiatives became self-sufficient, independent organizations.Through our efforts, we will work to address systemic poverty, build equitable opportunities, create healthy communities, and ensure inclusive growth.

You'll see the impact of our work throughout the year first hand when you meet Yesenia Franco, a proud mother whose daughter has already chosen her college—even though she is still an elementary school student at Equitas Academy. Our impact can also be seen through visiting Unity Health Care with Michele Reynolds, who, along with her neighbors in Washington D.C.’s Ward 5, now has access to quality care. You will also experience the kindness of Meals on Wheels volunteers in Texas who bring hot meals to Kajl, an accomplished chef no longer able to prepare all his own meals.

As impressed as I am with the impact we had in 2015, I’m equally excited about what lies ahead. This year marks the launch of our new five-year strategy. Core to that effort is working with all of you to build a nation of communities built on a foundation of equity, opportunity and inclusiveness. It is an appropriate North Star for our ambitious agenda.

Through our efforts, we will work to address systemic poverty, build equitable opportunities, create healthy communities and ensure inclusive growth.

This will require us to expand our lending and implement new capitalization efforts that broaden our reach. We also plan to incubate, advocate and scale new and promising ideas through our policy to practice work. The following report will provide you with our initial roadmap.

I look forward to continuing Terry Simonette’s legacy. I am excited to join my colleagues in taking the bold steps necessary to find new ways to address the social and economic justice issues that impact underserved communities. I sincerely hope that you join us in shaping a new tomorrow.

2015 Impact Highlights

![]()

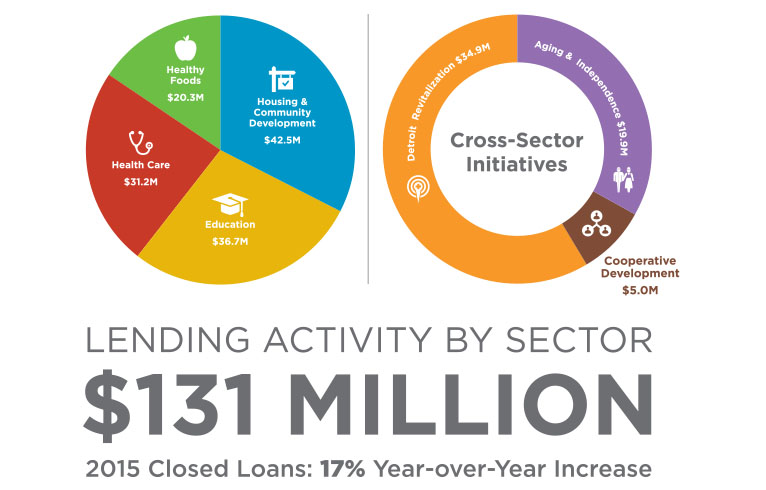

$131 Million Closed Loans

![]()

154,000

People Served

![]()

1050

Jobs Created

![]()

Education:

4,500 Students

![]()

Healthcare:

87,000 Patients

![]()

Healthy Food:

61,000 Customers

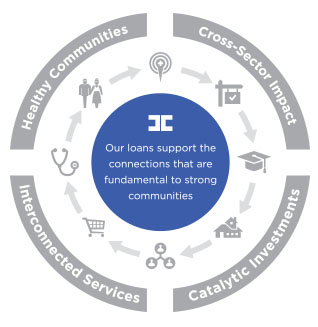

Financing That Supports Connections

SCOTT SPORTE

CHIEF LENDING OFFICER

CAPITAL IMPACT PARTNERS

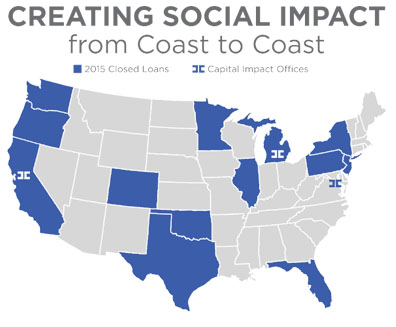

At Capital Impact Partners we put money to work, focusing our efforts on the best ways to use dollars to achieve powerful outcomes. Our lending work at Capital Impact Partners in 2015 increased more than 17 percent over 2014 —a success that we celebrate in the present as we look ahead to new levels of accomplishment. This lending volume is a source of strength as it supports our organization financially while simultaneously reinforcing communities with increased access to critical housing, services and employment opportunities.

The new Michigan Good Food Fund uses financing to increase equitable access to fresh, healthy food. The Fund focuses on reducing food deserts in cities like Detroit and Flint as well as rural areas north of the Mackinac Bridge. It also supports producers of locally grown fruits and vegetables as entrepreneurs and employers.

The new Michigan Good Food Fund uses financing to increase equitable access to fresh, healthy food. The Fund focuses on reducing food deserts in cities like Detroit and Flint as well as rural areas north of the Mackinac Bridge. It also supports producers of locally grown fruits and vegetables as entrepreneurs and employers.

Our new Age Strong Investment Fund, developed in partnership with the Calvert Foundation, AARP and AARP Foundation, connects the burgeoning world of impact investing with high impact organizations to provide needed services to low-income people aged 50 and up. With Age Strong, an investment as small as $20 that could be quietly earning interest in a bank is instead put to work constructing housing and providing access to health care for very low-income seniors in rural Colorado. That investment is also helping to eliminate a Philadelphia food desert so that closer proximity to food and community services enables more seniors to remain in their homes as they age.

We have also put our shoulder to the wheel in partnership with the Low Income Investment Fund and Reinvestment Fund to utilize the CDFI Bond Guarantee Program. This program benefits a KIPP school in Camden, New Jersey that constructed a new school for more than 1,000 pre-K through 8th grade students. This school provides high-quality educational options for neighborhoods whose traditional public schools are closing.

Our new lending strategy intends to make money work harder, achieving even deeper levels of impact in and across communities.

In Detroit, projects in the Woodward Corridor Investment Fund and Detroit Neighborhoods Fund began opening their doors to people from a mix of income levels, using our lending as a tool to transform vacant, blighted buildings into vibrant homes near transportation and services for existing and new Detroit residents.

The following sections of this report celebrate those accomplishments and their powerful impact on communities as we simultaneously look ahead to the next five years. Our new lending strategy intends to make money work harder, achieving even deeper levels of impact in and across communities.

As the accompanying graphic illustrates, our loans support connections. A loan to a community health center provides a new point of access for primary care. It also allows a senior to use the services of that nearby center to be healthier and remain at home longer. A loan to a retail grocer increases that retailer’s purchases of locally grown produce that in turn creates jobs and economic opportunity. Financing to a new apartment building in Detroit builds safer, walkable, mixed-income communities and local demand that supports retailers and other job-creating employers.

As the accompanying graphic illustrates, our loans support connections. A loan to a community health center provides a new point of access for primary care. It also allows a senior to use the services of that nearby center to be healthier and remain at home longer. A loan to a retail grocer increases that retailer’s purchases of locally grown produce that in turn creates jobs and economic opportunity. Financing to a new apartment building in Detroit builds safer, walkable, mixed-income communities and local demand that supports retailers and other job-creating employers.We accomplished much in 2015 and know that our diligent effort will lead to even more in the years to come. We are grateful to our partners and thank them for joining us as we look ahead to 2020.

I count myself exceptionally fortunate to have been part of this group of people across the country who continues to stand up for social justice and who imagines a world that enables all of us to succeed. I certainly will be farther back in the ranks of this army in the future, but for sure, I will continue to be a proud member of this movement and support it in every way that I can.

I count myself exceptionally fortunate to have been part of this group of people across the country who continues to stand up for social justice and who imagines a world that enables all of us to succeed. I certainly will be farther back in the ranks of this army in the future, but for sure, I will continue to be a proud member of this movement and support it in every way that I can.