Whether you’re a seasoned real estate developer fine-tuning your strategies or an aspiring newcomer eager to make your mark in the industry, there is always more to know and learn to help grow your business and scale your impact. This series is designed to provide invaluable insights and actionable advice to propel your development projects and your business forward.

At the Momentus Capital branded family of organizations, we harness the collective expertise of Capital Impact Partners, CDC Small Business Finance, and Momentus Securities to expand capital and opportunities for underestimated communities.

At Capital Impact Partners, in particular, we offer flexible and affordable financing to a diverse array of community development projects that deliver tangible social impact. From community health centers to affordable housing developments, we are committed to empowering projects that uplift communities and foster sustainable growth. We also offer programmatic services that equip you with the resources, support, and networking opportunities you need to succeed in the real estate development world.

In the competitive realm of real estate development, success hinges not only on vision and execution but also on the ability to navigate complex relationships, craft solid projections, and attract investors. These pillars serve as the bedrock upon which thriving projects are built, distinguishing between mere ventures and enduring successes.

In this final installment of our series, let’s explore the key elements that set a developer up for attracting investors for real estate development, as well as strategies for anticipating and meeting their needs.

Financial Statements and Bankability

Ensuring that developers’ balance sheets and other financial statements accurately reflect their business’ health is paramount to attracting investors for real estate development. Lenders and investors look for reliability, organization, and trustworthiness when evaluating potential projects. By conveying a deep understanding of the project, its financing strategy, and the market, developers can instill confidence and mitigate lender scrutiny.

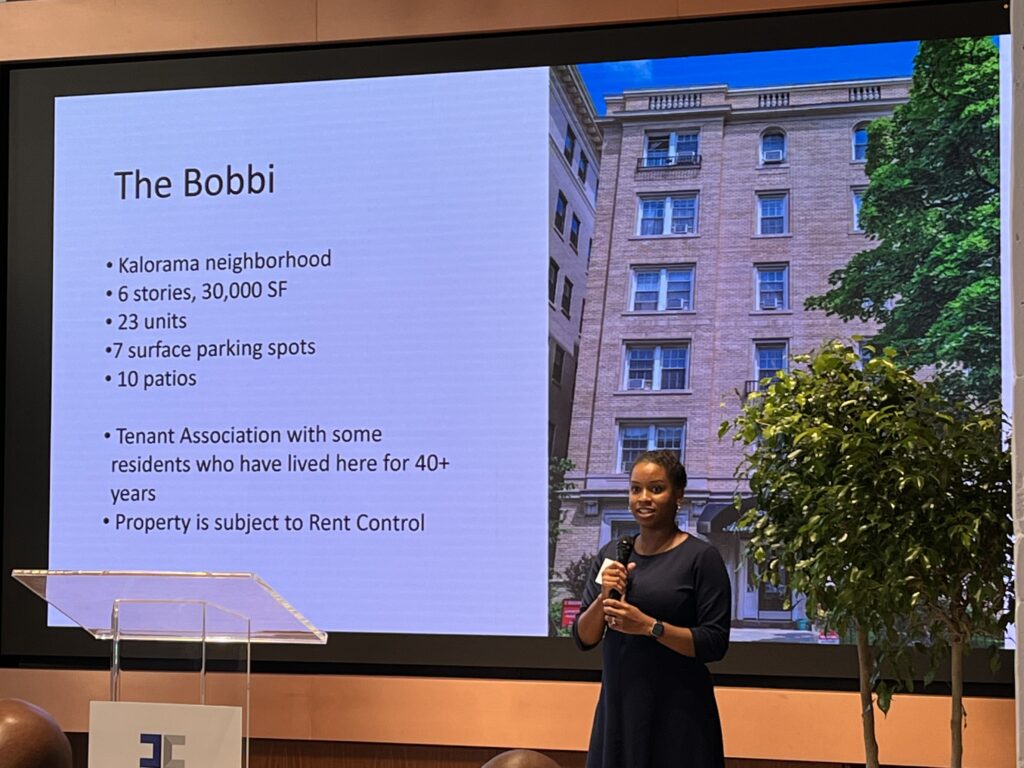

“For the Bobbi project, I was able to prepare for lender scrutiny by knowing the deal inside and out better than any consultants on my project, and being able to articulate the vision, the financing strategy, and the market.” – Ronette (Ronnie) C. Slamin, Founder and Principal at Embolden Real Estate

Anticipating Investor and Lender Needs

Before approaching lenders or investors, developers must ask themselves critical questions about their project and financing strategy. Being upfront about personal finances, including credit score and debt payment history, is essential for building trust and credibility. By aligning project goals with lender portfolios and understanding their business models, developers can tailor their pitches to meet lender and investor needs effectively.

Professional Patience and Effective Communication

Patience is a virtue in real estate development, particularly during the funding and underwriting phases. Rushing the underwriting process can lead to misunderstandings and delays, so developers must approach it with professionalism and collaboration. Maintaining effective communication, especially in challenging situations, is crucial for building strong relationships, attracting investors, and hence securing financing.

By emphasizing transparency, aligning with lender objectives, and fostering collaboration throughout the underwriting process, developers can forge robust partnerships with lenders and investors, ensuring the financing needed for their projects.

Contact us today to start a conversation about how Momentus Capital can support your journey to success.