Capital Impact Investment Notes

Terms & Financial Highlights

Capital Impact Investment Notes are being offered at fixed interest rates, with multiple terms, and may be purchased directly through your brokerage account.

How to Invest

Individual Investors can purchase Capital Impact Investment Notes directly through their brokerage accounts.

Investment Professionals can contact our lead sales agent, InspereX, for further information about Capital Impact Investment Notes.

| Investment Note Terms | |

|---|---|

| Total Offering | $250,000,000 |

| Financial Return | Fixed Interest rates; Terms up to 20 years |

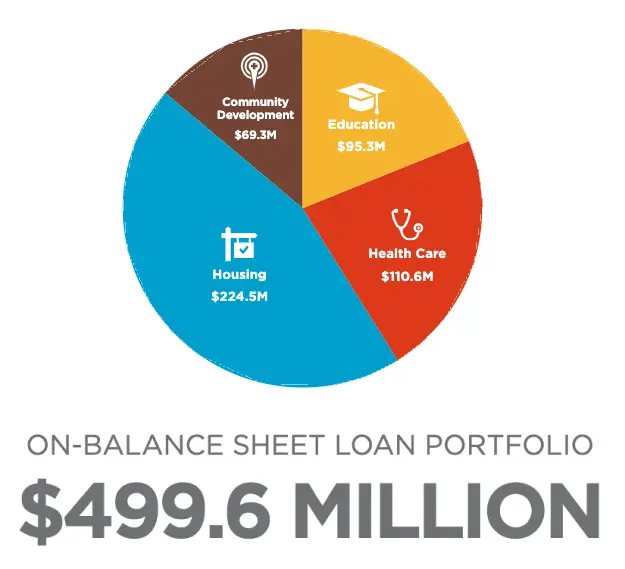

| Social Return | Delivers social impact to underserved communities across multiple sectors nationwide. S&P Global Ratings has opined that Capital Impact’s Social Bond Framework is fully aligned with the 2023 Social Bond Principles of the International Capital Market Association (ICMA). |

| Minimum Investment | $1,000 |

| Investment Grade Rated | S&P Global and Fitch Ratings have both assigned the Capital Impact Investment Note an investment-grade rating. Full rating details can be downloaded from our website.* |

| Convenience | Available for purchase through your brokerage account |

If you are looking for Pricing Supplements from previous offerings, please select the version you are looking for by clicking below and browsing the drop-down menu.

View Past Supplements

- Expired 09-2024 Capital Impact Partners Investment Note Pricing Supplement

- Expired 08-2024 Capital Impact Partners Investment Note Pricing Supplement

- Expired 07-2024 Capital Impact Partners Investment Note Pricing Supplement

- Expired 06-2024 Capital Impact Partners Investment Note Pricing Supplement

- Expired 05-2024 Capital Impact Partners Investment Note Pricing Supplement

- Expired 04-2024 Capital Impact Partners Investment Note Pricing Supplement

- Expired 03-2024 Capital Impact Partners Investment Note Pricing Supplement

- Expired 02-2024 Capital Impact Partners Investment Note Pricing Supplement

- Expired 01-2024 Capital Impact Partners Investment Note Pricing Supplement

- Expired 12-2023 Capital Impact Partners Investment Note Pricing Supplement

- Expired 11-2023 Capital Impact Partners Investment Note Pricing Supplement

- Expired 10-2023 Capital Impact Partners Investment Note Pricing Supplement

- Expired 09-2023 Capital Impact Partners Investment Note Pricing Supplement

Disclaimer: This is not an offer to sell or a solicitation of an offer to buy any securities. Such an offer is made only by means of a current Prospectus (including any applicable Pricing Supplement) for each of the respective notes. Such offers may be directed only to investors in jurisdictions in which the notes are eligible for sale. Investors are urged to review the current Prospectus before making any investment decision. No state or federal securities regulators have passed on or endorsed the merits of the offering of notes. Any representation to the contrary is unlawful. The notes will not be insured or guaranteed by the FDIC, SIPC or other governmental agency.

*Ratings from S&P Global and Fitch Ratings are not a recommendation to buy, sell, or hold Notes and may be subject to suspension, reduction, or withdrawal at any time by the respective rating agencies. Please check the pricing supplement on our website for the ratings assigned to the Notes currently being offered for sale.

Looking for more information?

Investor Toolkit

Financial Highlights

| Debt & Net Asset Composition as of 12/31/2023 | |

|---|---|

| Debt | |

| Revolving Lines of Credit | $69,500,000 |

| Notes Payable | $68,786,736 |

| Investor Notes | $265,412,000 |

| Subordinated debt | $14,500,000 |

| FHLB-A | $24,000,000 |

| Bond Loan Payable | $5,000,000 |

| Subtotal Debt | $447,198,736 |

| Less Investor Notes issuance costs | ($2,606,852) |

| Total Debt(4) | $444,591,884 |

| Net Assets | |

| Without Donor Restrictions(1) | $106,347,815 |

| Noncontrolling Interest(2) | $20,572,345 |

| Total Net Assets without donor restrictions | $126,920,160 |

| With Donor Restrictions(3) | $45,321,327 |

| Total Net Assets | $172,241,487 |

| Total Capitalization | $616,833,371 |

|

A Strong History of Social & Financial Impact

A Mission-Driven Community Development Financial Institution

+

Working Since

1982

on Social and Racial Justice Issues Nationwide

=

$3+

Billion

Invested in Communities to Deliver Social Impact