Capital Impact Partners Joins Call Asking Congress to Support the Capital Magnet Fund

Tool is a Proven Solution for Affordable Housing in Underserved Communities

Washington, DC (January 27, 2015) – We can say with growing certainty that the economy is in recovery. Unemployment, the stock market, and other economic indicators have reached pre-recession levels. However, millions of low-income American families are still struggling to find stable, affordable housing.

According to a recent Zillow report, rents are up 52 percent nationally since 2000, while renters’ incomes have only increased 25 percent. More than half of households earning less than $30,000 a year spend half their income on rent, leaving little for necessities such as food, medical care, transportation, or savings. There is simply not enough housing affordable to poor households.

Yet, an effective tool created by the US Treasury Department’s Community Financial Development Fund to combat this issue is facing congressional scrutiny. Capital Impact Partners joins with colleague organizations including IFF, the Low Income Investment Fund (LIIF) and The Reinvestment Fund (TRF) in asking Congress to continue its support for the Capital Magnet Fund (CMF) program.

Enacted in the early days of the economic crisis through the Housing and Economic Recovery Act of 2008, the CMF and the National Housing Trust Fund (NHTF) were specifically designed to increase America’s supply of affordable rental housing. The CMF in particular was created as a way for high-capacity organizations to attract investment into affordable housing and spur economic development in distressed communities.

A Proven Track Record of SuccessWhile the demand for affordable housing that led to the creation of CMF and NHTF intensified, payments to the programs were suspended when Fannie Mae and Freddie Mac were put into government conservatorship. But the one-time $80 million Congressional appropriation for the CDFI Fund within the Department of Treasury in 2010 enabled CMF and its grantees to clearly demonstrate the program’s effectiveness and impact.

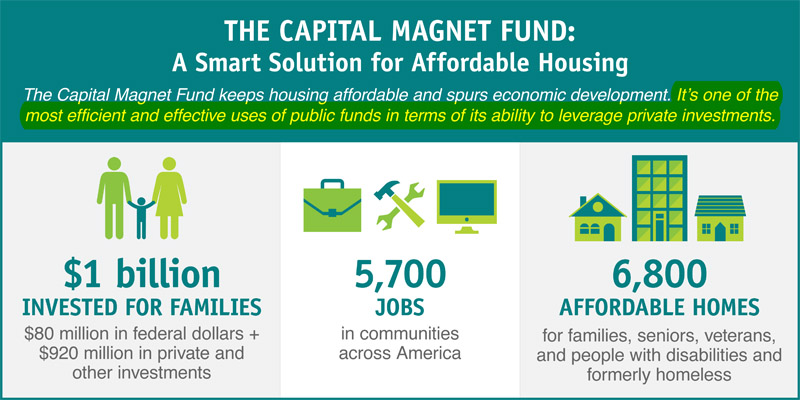

Twenty-three organizations received the initial round of $80 million in CMF awards. With these funds, awardees attracted 12 times that amount for a total of more than $1 billion invested into communities—much of it from the private sector—creating nearly 7,000 affordable homes and 5,700 jobs in 28 states, Washington, DC, and Puerto Rico (through July 2013). Among CMF’s other benefits are the following:

- Investing in top-tier organizations: CMF awards are available to high-capacity organizations, including housing developers, such as Abode Communities, Habitat for Humanity and Volunteers for America, as well as Community Development Financial Institutions such as Capital Impact Partners, IFF, the Low Income Investment Fund (LIIF), and The Reinvestment Fund (TRF). These organizations have strong track records in building and preserving affordable housing in low- income communities. CMF awardees from the 2010 round used just 2.5% of their awards for their own costs in administering the grants.

- Successful private-public partnerships to spur economic development and create jobs: LIIF received $6 million through the fund that leveraged more than $130 million to support 1,500 units of affordable housing and more than 200 jobs. In Dallas, LIIF’s CMF investment helped preserve 280 units of affordable housing and provide after-school and summer programs for youth and teens, along with health and nutrition classes. This one project created 56 local jobs for Dallas residents. Similarly, TRF’s $5 million award will support at least $75 million in additional investment. In West Philadelphia, CMF funds are helping to build and renovate 45 different properties, creating 60 affordable homes and 15,728 square feet of commercial space that will spur economic development. CMF funds are also helping develop a complex of 150 new and rehabbed energy-efficient townhomes for rent and for sale in East Baltimore.

- CMF keeps capital working: The $80 million allocated has led to more than $1 billion invested to date and the revolving nature of the fund ensures this money continues to work for communities. Funds deployed from the 2010 round are already being repaid and reinvested.

The CMF is an efficient use of federal resources and one of the most effective tools available to get private investment working to help address our nation’s housing challenges. It is leverage that works for the neediest families and America’s economy as a whole.

Terry Simonette, President & CEO, Capital Impact Partners;

Nancy O. Andrews, President & CEO, Low Income Investment Fund;

Don Hinkle-Brown, President & CEO, The Reinvestment Fund;

Joe Neri, CEO, IFF;