November 16, 2022 (Arlington, VA/San Diego, CA) – The Momentus Capital branded family of companies is proud to launch its Impact Investments line of business to jumpstart growth-stage, for-profit businesses that are creating social impact.

Many of these companies need something other than traditional debt — so that they can instead concentrate their resources on growing their enterprises. However, those opportunities are often not available. For example, equity investments make up less than 2% of CDFI portfolios in the United States.

“As a mission-focused organization, we provide support in a way that helps owners maintain control over their companies. We work alongside these owners to help them grow — seeking a modest, short-term return while enabling owners to maximize their impact within the community through economic growth and job creation,” said Ellis Carr, president and CEO of CDC Small Business Finance and Capital Impact Partners, each of which is part of the Momentus Capital branded family of organizations.

This is another innovative approach to providing a continuum of financial, knowledge, and social capital to advance community solutions.

“We are regenerative rather than extractive. That is vastly different from the way traditional venture capital tends to operate,” Mr. Carr added. “Most for-profit investors seek to maximize financial returns and make decisions that serve their own interests rather than the interest of the businesses or the communities in which they operate.”

Instead, Momentus Capital’s Impact Investments line of business works to ensure that equity stays with the entrepreneur. As the business grows and targets are reached, Momentus Capital takes a percentage of revenues or profits, with the goal of exiting completely and selling shares back to the business owner within 3-5 years.

Initial Supporters

Momentus Capital’s Impact Investments line of business has already received commitments from the following supporters: JPMorgan Chase; Macy’s, Inc.; Max M. & Marjorie S. Fisher Foundation; National Cooperative Bank; Northwestern Mutual; PNC Bank; the University of Maryland Medical System; U.S. Bank; and Westfuller.

The current target geographies for Momentus Capital’s Impact Investments line of business include Atlanta; California; Detroit; Miami; the New York Tri-State area; Seattle; the Texas Triangle area; and the Washington, D.C., Metro area.

Some of the first investees include:

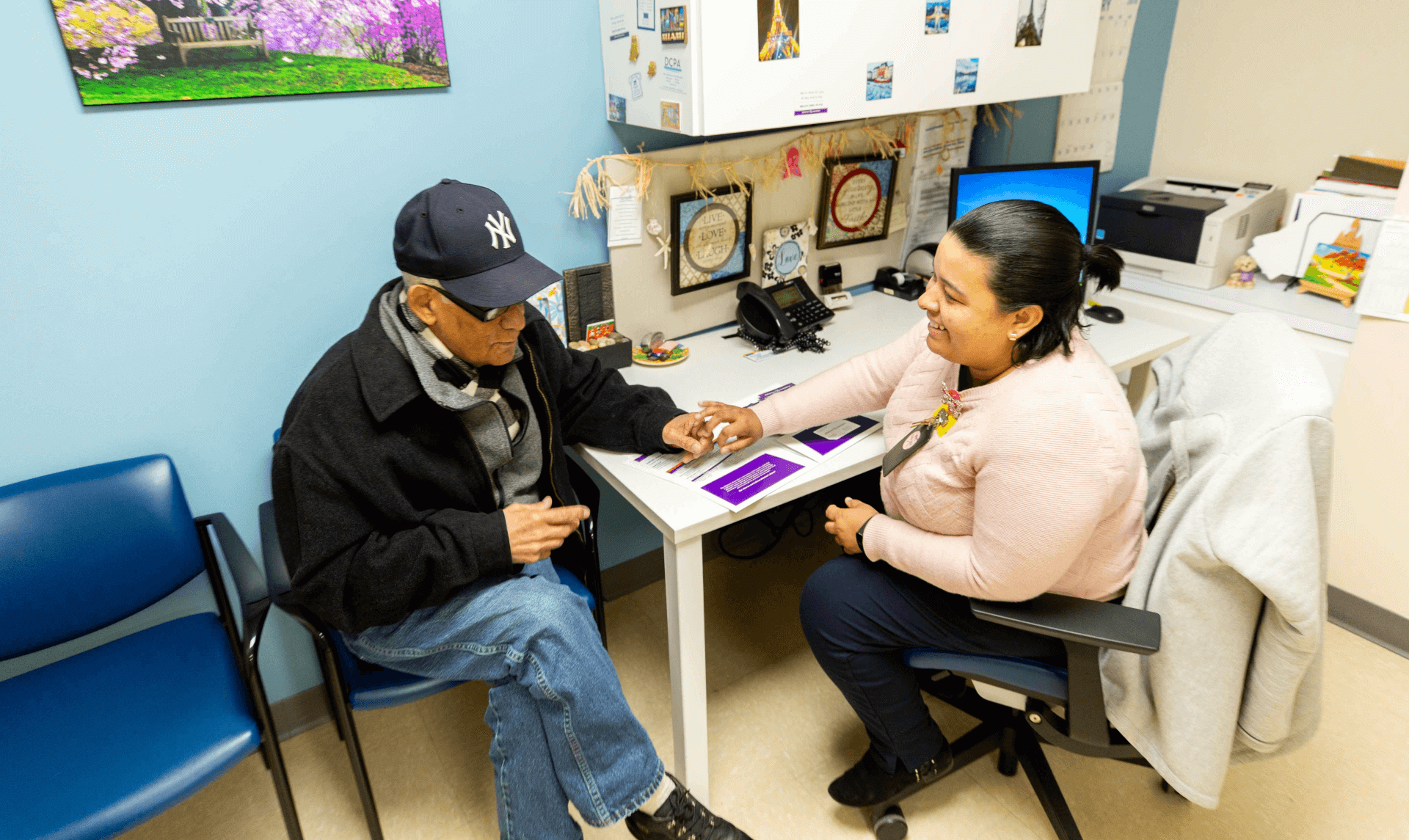

- SameSky Health, a Los Angeles area-based company focused on increased access to health services.

- Obran Cooperative, a Baltimore-based conglomerate whose subsidiaries include Obran Health. It is working to increase access to quality home health care in Southern California.

“It was clear to us that Momentus Capital values working with partners to impact change in the health care system,” said Abner Mason, CEO of SameSky Health. “Their approach allowed us to easily structure a deal that was fair to everyone. Momentus Capital stands out from others for their flexibility in working with our team and their ability to quickly move toward a transaction to help us continue scaling.”

“Growth-stage, community-centric businesses can be the economic engines for job creation and community development, yet these enterprises are often not the focus of traditional financial institutions and are poorly served by investors,” Mr. Carr said. “Momentus Capital works with these entrepreneurs and community development leaders to ensure a continuum of capital and training programs that set up their businesses for success.”

These businesses are also able to tap into the more than 80 years of combined small business and community development experience that Momentus Capital brings to the table, including:

- Business advising and capacity building programs

- Early- and growth-stage loan products, both traditional and alternative

- Non-dilutive preferred equity whereby cash flow positive businesses pay a fixed payment and dividend

- Mezzanine debt that helps companies bridge between rounds of equity

- Revenue/profit-sharing structures that can be used standalone or in combination with the above

“Our approach and experience enables us to work with companies at various stages, including critical growth points, and provide tailored solutions to fit businesses’ needs,” Mr. Carr said.

More information is available on the Impact Investments website.

###

About Momentus Capital

The Momentus Capital branded family of organizations refers to the combined operations of Capital Impact Partners and CDC Small Business Finance, as well as their affiliates, Momentus Direct Capital, and Momentus Securities (an SEC-registered broker-dealer, MSRB-registered, FINRA/SIPC member). While each organization under the Momentus Capital brand still operates as a separate entity, its clients now have access to more resources and products.

The Momentus Capital branded family of organizations is transforming how capital and investments flow into communities to provide people access to the capital and opportunities they deserve. We are working to reinvent traditional financial systems by offering a continuum of financial, knowledge, and social capital to help entrepreneurs, community-based organizations, and local leaders at every growth stage to build strong communities and create generational wealth.

This includes a comprehensive package of loan products, impact investment opportunities, training and business advising programs, and technology solutions that advance locally-led solutions.

Leveraging more than 80 years of combined experience, more than $3 billion in assets under management, and strong community engagement, the Momentus Capital branded family of organizations has delivered $24 billion in financing, created and preserved 298,000 jobs, and served 14,350 small businesses and 6 million people across our history.

With headquarters in Arlington, Virginia, and San Diego, California, Momentus Capital operates nationally with a focus on larger urban areas and cities in Arizona, California, Georgia, Michigan, Nevada, New York, Texas, and the Washington D.C. metro area.

Learn more at momentuscap.org.