When developer Richard Hosey returned to Detroit in 2008 after nearly 15 years, the city was not what he remembered.

“The Detroit of my childhood was much more vibrant. We had block clubs and close-knit neighborhoods,” Hosey recalls. “People still aspired to live in the city. When I returned, people were aspiring almost exclusively to live in the suburbs. That disappointed me.”

After attending graduate school at Tulane University, Hosey began his career working in real estate, rehabbing historic structures in New Orleans. He worked for several more developers in New Orleans and Baltimore before launching a career in community development banking. But he always knew he was coming back to Detroit.

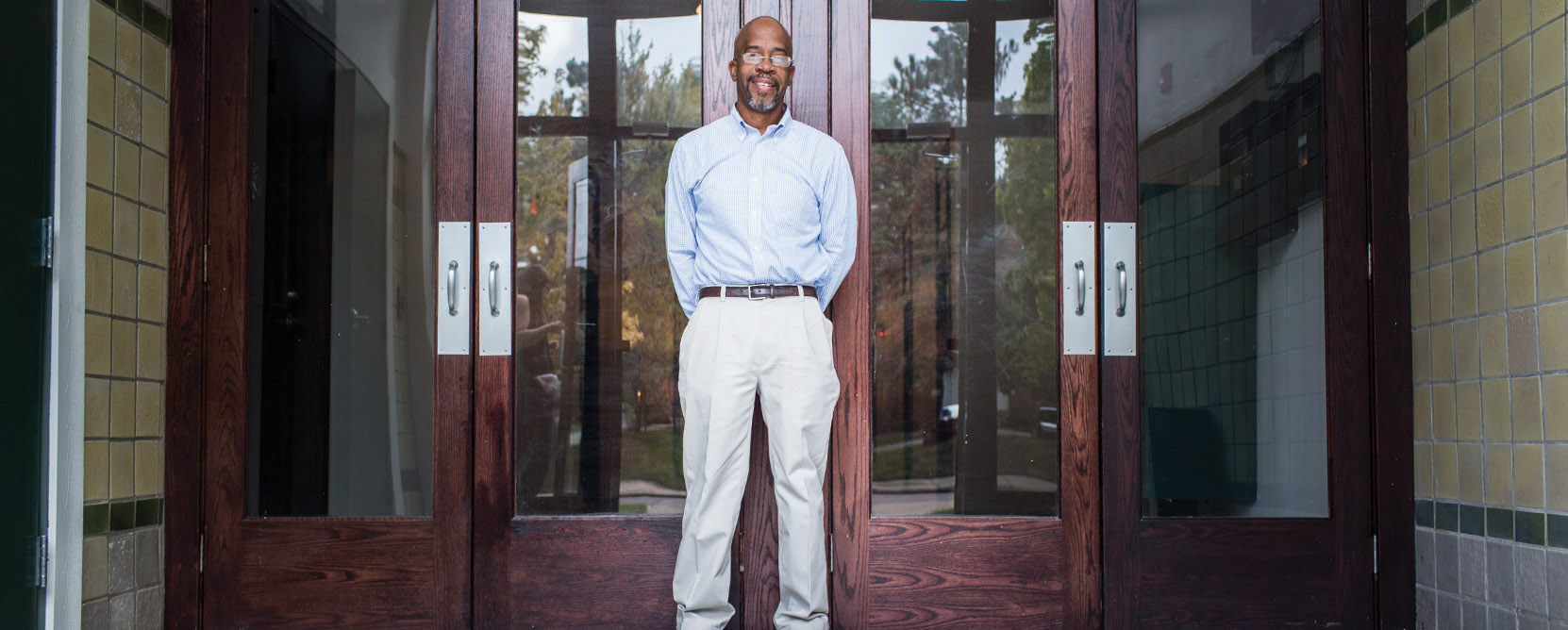

A native of Detroit, Richard Hose returned to the city in 2008 to help revitalize the city.

“I’ve always been a big fan of the city and thought it had a lot of promise,” he says. “I was just looking for the opportunity to come back.”

That opportunity finally came in 2008 when Hosey’s employer, Bank of America, acquired a regional bank in Detroit, giving Hosey an opportunity to move home. As he returned, the financial crash was just getting underway, and Detroit was inching closer and closer to rock bottom. Although he was dismayed by what he saw, the optimist in him saw an opportunity.

“Some of the corruption and policies that had been plaguing the city were being cleared, and it provided a basis for us to grow,” he says.

Turning Detroit’s Misfortune into an Opportunity for Growth

By 2013, Hosey felt the time was right to return to development. He resigned his position with Bank of America and set about using the skills he had acquired to build his own development company.

“When the opportunity presented itself in a way that grabbed me, that’s when I decided to go for it,” he says.

In this “audio postcard” Developer Richard Hosey talks about the challenges and opportunities he has faced in bringing projects online in Detroit.

For Hosey, the opportunity came in the form of the former Tushiyah United Hebrew School at Kirby and St. Antoine streets in Midtown. When he saw the old school building that would eventually become his first project, it was in very poor condition.

“There was kind of makeshift furnaces set up in the hallway that someone had brought down. There were whole sections of the building blocked off with wood barriers because there were leaks and ceilings had fallen,” he recalls.

But Hosey had seen many derelict buildings like this one transformed through more than 80 similar projects in cities across the country.

The historic building that would ultimately become the Kirby Center Lofts was completely dilapidated when Hosey began work on it in 2013.

“I got really used to seeing a building being completely dilapidated. Maybe floors are missing, windows are missing, it’s filled with junk, and then seeing the end process where it looks brand new and wonderful,” he says. “That allowed me to look at certain buildings and notice the bone structure as opposed to the blight.”

Hosey saw the school building as an opportunity to help build a mixed-income neighborhood in Midtown. The school is adjacent to two properties—right next door is a mixed-income building, and across the street is a 100 percent low-income property. Hosey says that having that mix is important to building stability into a neighborhood.

“There was a very long history of only building low-income, subsidized housing in the city that didn’t allow for mixed-income neighborhoods,” he says. “If everyone in a new development has to be below a certain income, then the result is concentrated poverty.”

Both neighboring properties defy all negative stereotypes of what it means to be low-income housing—they are very clean and well maintained. Residents include professors, doctors as well as those with a low income.

Hosey acquired the building while he was still working at Bank of America. During the early stages, he would come at night to plan.

“A lot of people just thought I was crazy and would call me up and say, ‘Get out of that building, why are you down there knocking out walls,'” he laughs.

Hosey worked with Capital Impact Partners to structure a complex $6.9 million financing package for the Kirby Center Lofts projects.

Utilizing his background in development and banking, Hosey worked with Capital Impact Partners to structure a complex $6.9 million financing package, layering in multiple types of incentives to get the project off the ground.

CIP also managed the process and provided the bulk of the first mortgage. The Michigan Economic Development Corporation bought a piece of the loan. Invest Detroit, another local lender with an interest in Detroit’s revitalization bridged investment in state and federal historic tax credits.

Capital Impact Partners provided a second loan to bridge in another piece of the final incentives. Alongside all of that, Symetra Life Insurance invested in the project alongside Hosey as the developer. Symetra received the lion’s share of the federal historic tax credit with Hosey making up the difference.

“This was a relatively complicated financing package with several different sources of project funds,” says CIP’s Ian Wiesner. “Capital Impact had the expertise to understand the transaction and the mission focus to provide financing that traditional financial institutions wouldn’t consider to ensure this project got funded.”

Once abandoned, the Kirby Center Lofts have been turned into a 25-unit complex, bring much-needed housing to the mixed-income neighborhood

Today, Kirby Center Lofts features modern urban apartments including 21 one-bedroom units, two two-bedroom units, and two studio units. The building is almost completely occupied.

Using Experience to Overcome Obstacles

Hosey doesn’t sugarcoat the challenges of completing a project like this in Detroit. For example, he ran into trouble when trying to comply with the city’s local contracting requirement. Although he found that the predominantly minority local contractors possess the expertise, they often didn’t possess the necessary credit to purchase supplies. He first became aware of the issue when he hired an electrical contractor.

“The contractor did not have the money to pay for a $19,000 primary electrical box, and the supplier would not extend him the credit,” says Hosey. “He was trying to run the wire without the box so that he could get enough money to go buy the box while trying to do other jobs, saving up to hope to buy this $19,000 dollar box. It was holding up my job, making him look less competent and wasting wire.”

While Hosey is excited about working in his hometown, he does not sugarcoat the challenges of bringing new development online in Detroit.

When Hosey spoke to the contractor, he uncovered the problem and offered a solution: Hosey would front the cash to purchase the box.

“From there, we were able to move a lot more efficiently,” says Hosey. “I started talking to other contractors to let them know that we were willing to buy the supplies, and things moved a lot more smoothly.”

Hosey points to the Detroit Development Fund as one method for dealing with this issue.

“The Detroit Development Fund has put together a minority contractor loan fund, and I am sending people over there all the time,” says Hosey. “It helps them have the money to pull down the supplies.”

He’d like to see that program expanded and replicated. In Hosey’s view, capital and credit are the primary issues separating Detroit contractors from non-Detroit contractors.

Hosey’s experience working in New Orleans, Baltimore and St. Louis has helped him deliver creative solutions to his projects in Detroit.

“My experience is that Detroit contractors are no worse or better than non-Detroit contractors,” says Hosey. “The reality is once you adjust for the capital constraints, then you’re just dealing with contractors.”

Despite these challenges, Hosey sees Detroit’s issues as compared to other transforming cities he’s worked in.

“Executing a project in Detroit at this stage of its development is comparable to every other city I’ve worked in,” he says. “I had the opportunity to work in some of the very early stages of revival in New Orleans, Baltimore, downtown LA and St. Louis. It was quite an uphill slog for all of those cities.”

The most significant benefit of being a developer in Detroit, he says, is a low barrier to entry mixed with a solid set of supportive tools and resources, such as Capital Impact Partners, Invest Detroit, and the city and development community itself.

“We’ve really become a team of developers; we know that every finished project helps our projects,” says Hosey. “It really surprises people that it’s such a collaborative environment. There’s still all the need for capital and the ups and downs of development, but it’s a much more welcoming market than I’ve seen in any other city.”

LEARN MORE ABOUT OUR WORK