As Chief Coordinating Officer of Obran Cooperative, Joseph Cureton is working to use the cooperative model to advance health equity and give decision-making processes and capital back to the caregivers, operators, and healthcare workers.

Achieving the dream of helping sustain a more just, equitable, and effective health care system is key to Obran Cooperative’s mission. Joseph Cureton, the Chief Coordinating Officer of Obran Cooperative, is working towards this mission using the unique approach of rethinking how health care workers themselves are organized within these systems – as worker-owners of the care delivery enterprises where they work.

Cureton’s vision to create more equitable systems is informed by the observation that caregivers are often part of the communities they work in, and that empowering them with ownership is actually placing ownership into the hands of the community. This informed participation in leadership decisions is fundamental to the underlying principles of the cooperative movement. Cooperatives are member-owned organizations and companies, meaning that the workers own the business, participate in its management, and benefit from its financial success.

Obran, as a worker-owned cooperative conglomerate corporation itself, is giving decision-making processes and capital back to the caregivers, operators, and healthcare workers. This makes Obran a unique operator in that it is positively advancing health equity through its services, employment model, and ownership model. This is exemplary of the power of the cooperative movement and the new institutions being built.

“It’s about maintaining businesses that are for the community – when we look at our people and the systemic oppression or racism that has occurred that has caused these known health inequities,” Cureton said. “We wanted to wrestle back tools to put them in community control and recommit them to be a force for impact.”

As Chief Coordinating Officer of Obran Cooperative, Joseph Cureton is working to use the cooperative model to advance health equity and give decision-making processes and capital back to the caregivers, operators, and healthcare workers.

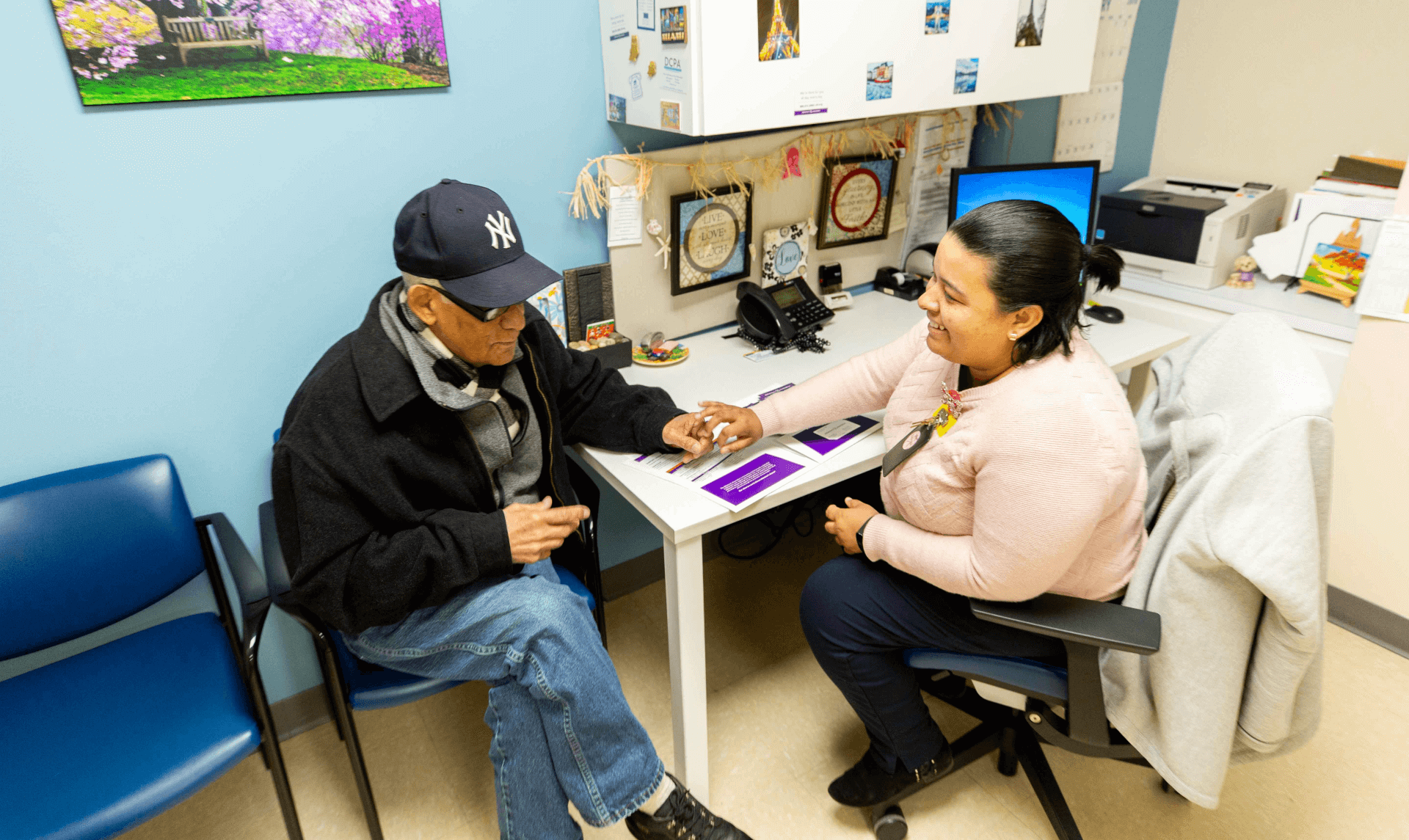

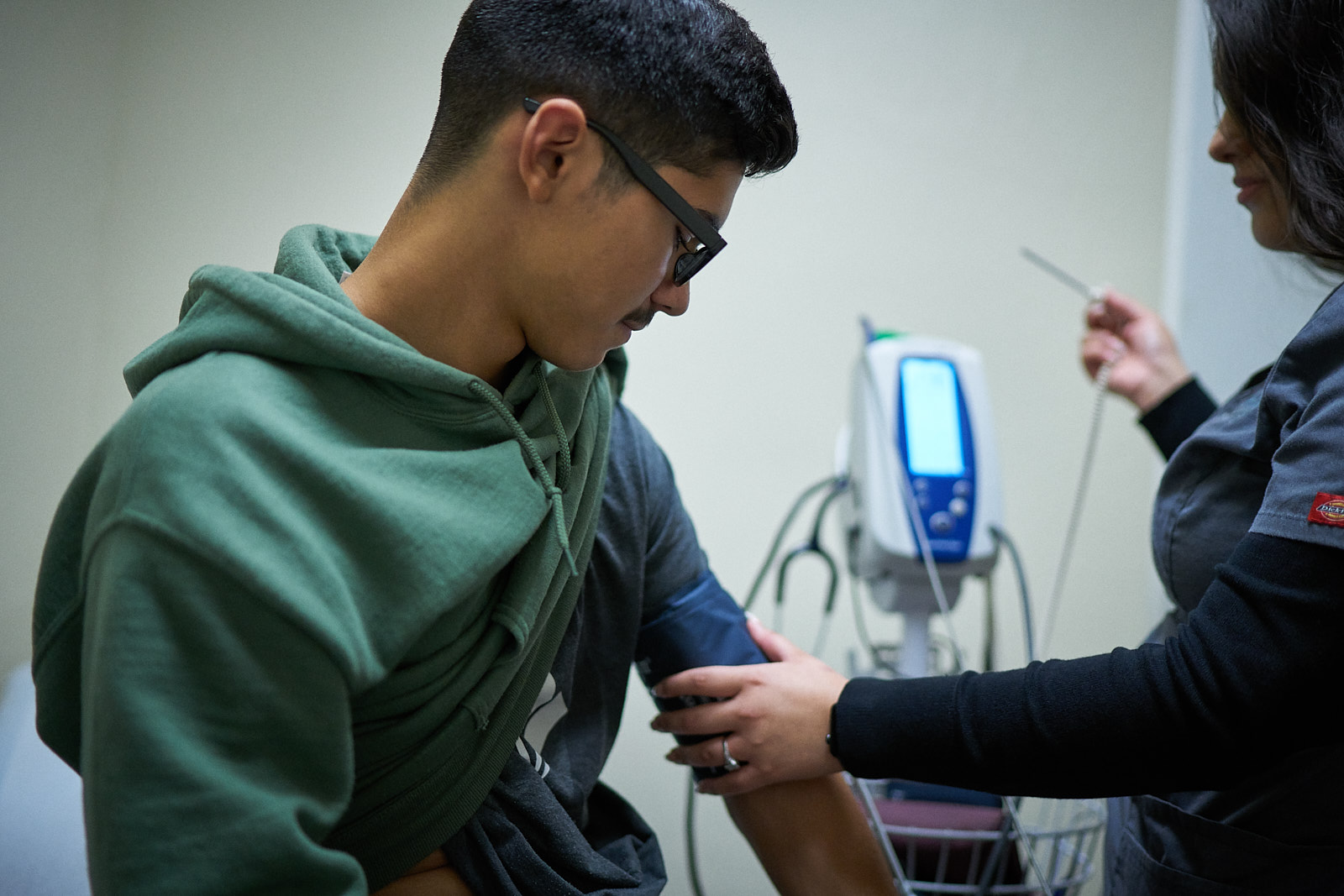

Working alongside Cureton, Adam Rose, COO of Obran Cooperative, spends a significant amount of time in community health care working to address the holistic needs and outcomes for patients, workers, and the community as a whole.

“Eighty percent of health care outcomes do not come from the actual treatment you receive, but from access to healthy living, good housing, food, education, etc.,” he said. “Systemic oppression and inequity are real, and our large initiative centers around uniting the ownership group with the worker group so that everyone can access the full value of the fruits of their labor. This is a major step to advance wealth and health.”

Fundamentally changing systems then requires improving outcomes for the worker-owners. Rose said that they not only think about the way Orban Coop affiliates provide services to patients, but also how they can further help health care providers get more out of their careers. This is especially important when you consider that home healthcare employees are predominantly female with strong representation by BIPOC women – individuals who often find themselves overlooked when it comes to pay and treatment.

Obran Cooperative is working to fundamentally change systems by improving outcomes for worker-owners. This means thinking about how its affiliates provide services to patients and how they can further help health care providers get more out of their careers.

It was these values that guided their approach when Obran sought to acquire Physicians Choice Home Health, a home health care provider in Los Angeles. Their goal was to help the company transition into worker-ownership and expand its footprint in Los Angeles and surrounding counties. In addition, Obran wanted to work through Physician’s Choice to increase access to quality home health care in Southern California, including in BIPOC communities.

“It’s really about building the culture of ownership and trust there. The primary focus has been gathering feedback from social workers, Resident Nurses and others, saying this is a business we all own, so let’s make it great,” said Rose.

However, Obran required an infusion of capital to finance the transaction.

While an easy solution may have been to seek out private equity or venture capital, this can come at cost, as those investors tend to focus more on how that investment can turn a profit instead of how to create an impact for communities. Similarly, turning to traditional banks with commercial loans or debt is equally limiting as they have very high criteria and restrictions. This can cause decisions that break from the mission of the organization or take away profits from the company and community.

Finding the right investment partner then required an organization who shared those same values.

That is when Momentus Capital, a family of mission-focused organizations that includes Capital Impact Partners, CDC Small Business Finance, and Momentus Securities came into the picture. Indeed, Capital Impact was founded in 1982 after the passage of the National Consumer Cooperative Bank Act to support and expand the cooperative sector in disinvested communities. Their work with cooperatives has been a core focus ever since.

“It is rare to find a company that is harnessing the cooperative model like Obran is. We share the vision and many of the same values with their leadership to support communities of color” said Elisabeth Chasia, Investment Director at Momentus Capital. “So we were excited to partner with them, learn about their goals and approach, as well as the needs of the worker-owners, to ensure we could structure the right equity investment.”

It was not a straightforward transaction, noted Chasia. But Momentus Capital brought a flexible approach based on those early conversations to ensure their impact investment helped deliver growth while also being community-centric.

Ultimately, Momentus Capital made a $1 million preferred equity investment in Physicians Choice, to support Obran Health’s acquisition.

That investment came with another big plus for Obran and its worker-owners.

“We are using non-dilutive capital, which is great for co-ops because we’re not taking ownership away from the employees,” she said. “We made an equity investment where we are being paid a portion of the profit of the company over the next three to five years. Then we exit and they retain full ownership.”

While Momentus Capital will make a profit from its investment, this unique approach helps ensure that the true wealth-building opportunities stay with the employees and the community.

“Unlike a turnaround or a business that is potentially on its last breath, we target businesses that are able to expand and use the equity to capitalize on additional growth,” Cureton said. “Equity makes sense in Obran Cooperative’s structure, to acquire and roll up various other groups, in markets that are growing, not contracting.”

Rose agreed that this worker co-op structure has harmonized incentives. There’s an operative and growth approach that takes a page out of the private equity book.

“We look at Momentus Capital as a partner who can run with us and we see there being big opportunities with the right capital,” Rose said. “We are working with a unique social enterprise that is squarely focused on delivering value for our members. Momentus Capital is a great partner and is leading the way in terms of how folks should think about impact capital.”

“It is rare to find a company that is harnessing the cooperative model like Obran is. We share the vision and many of the same values with their leadership to support communities of color,” said Elisabeth Chasia, Investment Director at Momentus Capital.

In the end, both Cureton and Rose agree that more equity and senior debt deals are on the horizon. They’re ready to tap into the full suite of services that Momentus Capital has to offer to grow other social impact areas, including affordable housing for members, as well as other opportunities to generate wealth.

“We’re in it for the relationships. This is not just a one-off transaction, it’s a long-term vision that we are looking into with multiple industries and sectors in mind, not just health,” Cureton said. “We want there to be a way for our members to fully recognize the fruits of their labor, and Momentus’ approach helps our companies transition to worker ownership in this new way. It’s exciting. Having an aligned capital provider at the table that is willing to actually listen to what communities want and respond to it is a game changer. Not just for our business, but for social entrepreneurs who are pushing on the real challenges we face across the country.”

Learn More About Our Coop Work

We’ve supported the Cooperative Community for more than four decades. Learn about how we can help yours.

Impact Investing for Health Equity: Q&A With SameSky Health CEO

We sit down and talk with SameSky Health CEO as he explains the importance of receiving an impact investment from Momentus Capital to grow his company.

The Momentus Capital Family of Organizations

Momentus Capital’s president and CEO describes how we are transforming the financial sector to better serve underestimated communities.