Attracting Private Capital to Communities

One of the persistent economic challenges that communities living with low incomes across the nation face is the lack of access to private investment capital for local business and real estate projects.

To overcome this hurdle, the New Markets Tax Credit Program (NMTC) was created by Congress and is administered by the U.S. Department of the Treasury’s Community Development Financial Institutions Fund.

This program helps mission-driven lenders like Capital Impact Partners attract private investment capital to disinvested communities by providing individual and corporate investors a federal tax credit in exchange for making investments in businesses or economic development projects. This incentive bolsters our ability to provide loans to projects delivering social impact in communities across the country, creating economic mobility and wealth creation.

As of September 2024, Capital Impact Partners has received $792 million in New Markets Tax Credit Allocation.

We invite you to speak with our team to learn how we can utilize New Market Tax Credits to finance your project in underserved communities. Capital Impact Partners is primarily focusing our tax credit allocation in support of health care, education and supportive services within our five core geographies. We can continue to provide leverage and sponsor loans in all of our focus sectors.

Advantages of Utilizing the New Markets Tax Credit Program

- Specifically designed to finance projects in disinvested areas;

- Flexible financing supports a variety of projects delivering social impact;

- Encourages private investment that enables multi-million-dollar financing deals;

- Supports affordable loans with terms and conditions more favorable than the market typically offers. Terms can include interest-only payments, high loan-to-value ratios, and equity infusions into the project; and

- Provides investors with federal tax credits as a result of program participation.

How do New Markets Tax Credits Work?

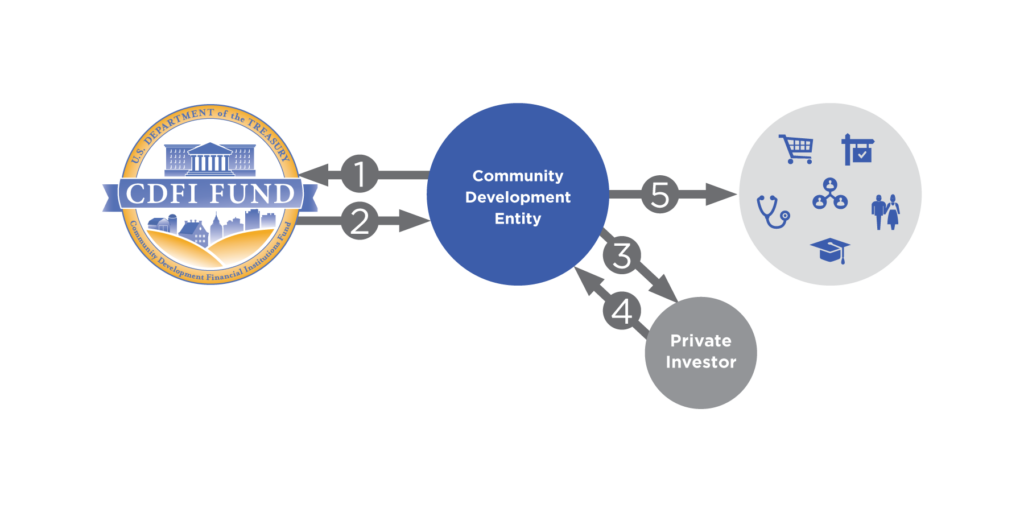

The CDFI Fund makes NMTC awards to certified Community Development Entities – like Capital Impact Partners – through a competitive application process. Here’s how the program works:

- A community development entity (CDE) submits an application to the CDFI Fund requesting the authority to allocate a specific dollar amount of tax credits.

- If its application is approved, the CDE is awarded the authority to allocate tax credits to an investor.

- The investor chosen by the CDE receives a tax credit totaling 39 percent of the cost of the investment. The investor can claim that tax credit over a period of seven years.

- In exchange for those tax credits, the investor makes a qualified equity investment (QEI) in the CDE.

- The CDE must use the QEIs it receives from the investor to finance businesses or real estate projects in communities living with low incomes, where the poverty rate is 20 percent or higher or the median income is 80 percent or lower than the Area Median Income. The CDE also has the option of investing in other CDEs making loans in areas with residents earning low incomes.