By Ellis Carr, President and CEO

2022 is a special year for us at Capital Impact Partners as it marks our 40th anniversary. Four decades of leaning into helping people build communities of opportunity and developing pathways to success.

And while this is an exciting time for us as we embark on a new strategy under Momentus Capital, it is equally important to remember our roots as a champion for the cooperative movement.

Co-ops represent a cultural shift away from blind profit toward shared social benefit. It is a model that challenges the status quo and offers workers, especially workers of color, an alternative to extractive systems.

These principles not only shaped our work in the very beginning, but continue to anchor our strategy as we grow and evolve and develop new business lines and affiliate organizations. They even underpin our newest vision statement to help create an economic system that respects and uplifts all peoples’ right to achieve the dreams they have for themselves, their communities, and generations to come.

Our Co-op Beginning

While we are now a national organization of nearly 300 staff members across our family of organizations, Capital Impact’s beginnings were quite humble.

In 1978, Congress rightly saw the need to better support the cooperative movement. That led to the passage of the National Consumer Cooperative Bank Act and the creation of the National Cooperative Bank.

Four years later, a tiny division known as the Office of Self-Help Development and Technical Assistance was launched to provide more focused work on bringing co-ops to underestimated communities and contribute to the economic development for people living with low-to-moderate incomes.

Over time, this effort grew and went through several different names before becoming Capital Impact Partners – the nonprofit Community Development Financial Institution we are today.

To date, Capital Impact has lent nearly $315 million in support of food, worker, and housing cooperatives, and has provided $725,000 in grants for co-op development.

More important than the numbers is the incredible journey of discovery to imbue our work with a co-op lens and shape the impact we can have with communities. It is a journey that has cemented our role as a mission-driven organization dedicated to fostering health, wealth, and justice for underestimated communities.

One our our first pamphlets…many names ago.

Expanding to Support Community Development

As our cooperative work expanded across the country, so did our support for community development more broadly. We saw that, for communities to be healthy and thrive, they needed a spectrum of vital social services, from health care to education to affordable housing.

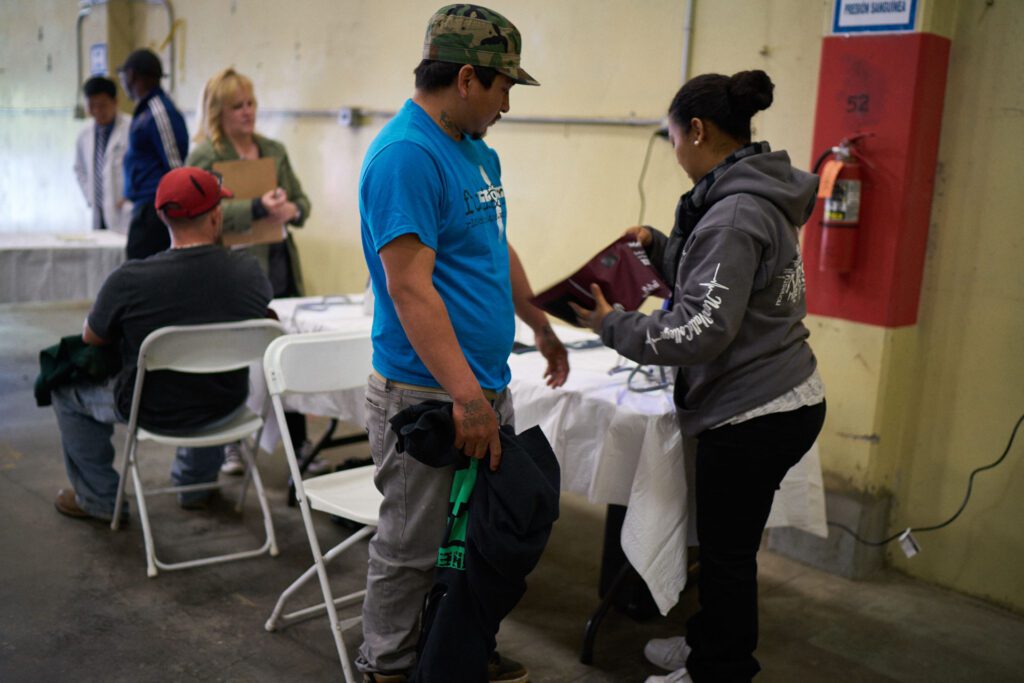

Farmers workers in California often have very little access to health care, so OLE Health takes health care into the fields.

Some of my favorite stories are about projects we’ve financed over the years that have had great impact on their respective communities. Like OLE Health, a health care provider in Northern California that recognized roadblocks to patient care and created programs to meet patients where they are. And Montessori for All, a free public charter school in Austin, Texas dedicated to “diverse-by-design” education, with a mission of achieving equitable academic outcomes for students across socioeconomic levels.

California farmworkers receive health care at a makeshift clinic created by OLE Health.

It was also a time where we expanded our approach to not just think as a lender, but how we could amplify community development through other organizations.

That led to Capital Impact joining with several leading nonprofit organizations to help form ROC USA Capital, a nonprofit that helps residents form cooperative corporations to purchase their manufactured home communities from private owners and manage their neighborhoods in perpetuity. The true power of what this means can be seen in Takesa Village, a community that we helped to finance so they could become stewards of their land.

ROC USA has championed the dignity inherent in all forms of housing, particularly manufactured housing, and build the power of manufactured home communities to control their own destinies

ROC USA, a longtime partner of Capital Impact Partners, helps residents of manufactured home communities, like Takesa Village, to purchase their community and operate it cooperatively, which has preserved affordable housing options across the country.

Evolution Toward Holistic, Place-Based Investment

Over the years, not only has our scope of work developed – but so did our footprint. We saw an opportunity to support Detroit communities in a holistic manner that would advance economic prosperity and social justice for longtime residents, an opportunity that led to a concerted place-based strategy.

In the early 2000s, when the Great Recession sent the Motor City reeling, we were asked by the Kresge Foundation to be part of the Living Cities Integration Initiative. This effort was designed to support the city’s revival by joining with other organizations to invest in a “place-based” strategy designed to foster holistic ecosystem change.

It proved to be a seminal moment for our organization. This strategy allowed us to draw and define on a map the different parts of the city where we knew our work would be most effective. It taught us the importance of what it meant to stand shoulder-to-shoulder with a community, understand the barriers it faced, and work with community members to implement their solutions.

This type of engagement at the local level provided a real understanding of what was going on in the neighborhoods that we serve.

Some great examples of developments we invested in Detroit and Michigan include The Auburn and Casamira – which brought affordable housing options and mixed-use space to local communities – and Imperial Fresh Market, a grocery store that serves its community in northwest Detroit with fresh, healthy food daily.

Imperial Fresh Market has supported its Detroit community with access to healthy food and quality jobs since the Shina brothers opened more than 20 years ago.

We found this approach so impactful that we applied this place-based strategy to our approach in other parts of the country, including northern and southern California, Michigan and northwest Ohio, Texas, the New York Tri-State area, and the Washington metropolitan area.

Equity Is the Beginning of Wealth and Health

Our work on the ground in Detroit also revealed another opportunity we had overlooked. While we were making good strides in our lending, we were missing entire swaths of the population who simply never had the opportunity to launch the kinds of projects we supported.

Opportunity has been historically driven by access to quality education to build quality jobs that build generational wealth. For residents of underestimated communities, access to the financing, training/education, and networks that would help them open businesses or engage in real estate development to build local wealth and health have been systematically denied.

That realization led to the creation of our Equitable Development Initiative (EDI) – a program that provides training, mentorship, and access to capital for developers of color – which has since expanded beyond Detroit to the Washington metropolitan area; the San Francisco Bay Area; and Dallas, TX, and has served more than 200 developers.

Through our Equitable Development Initiative, developers of color across the country get a foothold into the real estate development industry, with training, mentorship, and access to capital.

In leading this investment in developers of color, we listened to their needs around access to capital. Listening to the financing gaps they experienced led to us creating the Diversity in Development Loan Fund in Detroit and the Washington metro area, which will soon be expanded nationally.

Our work in listening to community members to develop products and services to support their needs has not gone unnoticed. Fast Company recently recognized Capital Impact’s work in their 2022 list of the Most Creative People in Business.

It was this understanding of the need to listen to communities and ensure that our strategy addressed systemic issues and barriers that led to another seminal program.

In 2015, we created and have continued to manage our Co-op Innovation Award to amplify innovative co-op business models in communities living with low incomes and/or communities of color. Since that time, we have supported 17 co-ops nationwide and disbursed $685,000 in grants, which helped our awardees leverage more than $9.1 million in additional funding from foundations, investors, and government.

Cooperatives are powerful tools for economic stability and wealth building. Our Co-op Innovation Award has given seed funding to innovative co-ops fostering self-determination nationwide.

Cooperatives have so much power to create economic stability and self-determination for residents of underestimated communities, and the power becomes greater when it can be scaled. Another conversation that we have been taking part in is around the potential of employee co-op conversions to foster a deeper level of economic mobility and stability. These conversions happen when a business owner sells the business directly to their employees, rather than into the market. With Baby Boomers retiring, many healthy businesses have no one to inherit the business and no buyers; as a result, these businesses are closing in record numbers, and that trend was only exacerbated by the COVID-19 pandemic.

In 2018, we published “Co-op Conversions At Scale,” a market research report to assess the growth potential of employee ownership (worker co-op) conversions in several markets, and convened CDFIs, small banks, and credit unions to learn about opportunities for scaling and financing co-op conversions.

In 2021, we turned that research into action and financed the employee ownership conversion of Ward Lumber, a 130-year-old business in New York, allowing more than 40 employees to become worker-owners.

What we learned is that true transformation comes from deep investments in local ecosystems to change the systemic and historical issues that have kept communities from building generational wealth that would help them thrive.

New Horizons for Addressing Systemic Disinvestment

Today, we continue the throughline of our work, which centers on building prosperous communities through economic, social, and racial justice. We are challenging ourselves to think bigger and more creatively about how to work hand-in-hand with community members to foster equitable and inclusive opportunities for wealth building.

In July of 2021, Capital Impact Partners, CDC Small Business Finance, and Ventures Lending Technologies came together to create the Momentus Capital family of organizations. This milestone was achieved through two years of work to come together as a new enterprise.

Momentus Capital is a first-of-its-kind financial organization that brings together leading companies rooted in social mission. Momentus Capital offers a continuum of financial, knowledge, and social capital to help local leaders build inclusive and equitable communities and create generational wealth. Together, we are now able to leverage our 80+ years of experience to offer our borrowers and partners an even more comprehensive set of solutions – including lending and impact investments, training and access to networks, and innovative technology – while also being more innovative and nimble than we could when operating separately.

Most recently, we began looking at the opportunity to offer more than just loans and grants, but also actual equity investments in companies run by diverse entrepreneurs and/or serving communities of color. Much like in other areas we focus on, Black communities are drastically underserved by the venture capital community. We decided this was another place we could make a difference by offering. To address this issue, we launched our impact investments program, which combines venture debt, revenue/profit-sharing agreements, and preferred equity investments to aid growth-stage businesses led by diverse entrepreneurs and employee-owners.

While we invest in a broad range of companies, it is critical that cooperatives be represented.

One of our very first investments was in Obran Health, a unique company that operates worker-owned healthcare companies. When Obran Health sought to acquire Physicians Choice Home Health, a home health care provider in Los Angeles, we provided a $1 million preferred equity investment. This allowed Obran to avoid the traditional route of syndicated loans and debt which would have hampered their long-term growth.

Innovating Systems for Thriving Communities

The opportunity for community impact is immense. Healthy communities are built by their residents. Small business owners, developers, and other local leaders are the engines of job creation and economic activity in communities across the country. When these leaders have the opportunity to succeed, their communities, local residents, and our country – thrive.

And while we are looking forward to catalyzing profound community transformation through Momentus Capital, we recognize that we are here because of the 40 years of expertise we have built with our colleagues and partners. We will always remember our roots in the cooperative movement and will continue investments to expand that community. From loans and grants to seminal research and equity investments, our work through Momentus Capital opens up a whole new area where we can uplift co-ops and support their work.

I am so proud of where Capital Impact Partners has come in the course of the last 40 years, and I cannot wait to see how Momentus Capital will innovate holistic approaches to get resources into the hands of more local leaders, entrepreneurs, and their communities.

As we continue to celebrate this milestone year, watch our 40th anniversary video series. The series includes rich reflections from the very people who have helped make us who we are, like Terry Simonette, my predecessor and Capital Impact’s longest-serving CEO; Paul Bradley, president of ROC USA; alumni of our Equitable Development Initiative; and so many more.

Watch our 40th anniversary video series!

I invite you to subscribe to our YouTube channel to hear these stories and experiences first-hand. We’ll continue to reflect on, recognize, and celebrate our 40 years in the months to come. I look forward to our continued work together to foster communities of opportunity because we are stronger together, and together, we are creating new pathways to build inclusive and equitable communities by providing people access to the capital and opportunities they deserve.

While the essence of our mission has remained the same over the years, it’s the people – staff past and present, our partners, the communities we’ve had the privilege of working in, and the countless other stakeholders – who are responsible for our journey and our evolution. It’s you who I find the most inspirational. You are the ones who have helped Capital Impact Partners become who we are today – a national Community Development Finance Institution (CDFI) committed to building a nation of communities built on a foundation of equity, inclusiveness, and cooperation.

I’m proud to celebrate and share this milestone with all of you.