Our Lending Products

Mission-driven Financing for Community-Centric Projects

Financing is one key tool that we use to help communities break barriers to success. As a certified Community Development Financial Institution (CDFI), we provide access to capital for projects often overlooked by traditional banks. We work directly with our borrowers to get the most complicated transactions done. For more than 40 years, we have partnered with mission-aligned developers, organizations, and small businesses to support neighborhoods and deliver social impact.

Loan Offerings to Meet Your Needs

Every project is different and we work to match your needs with the right loan product. We can do everything from predevelopment through mini-permanent financing, with a focus on real estate-backed loans of $500,000 and up. Our experience with complex projects and complicated capital stacks will help you get your project done.

Acquisition & Predevelopment Loans

Creative financing for mission-driven projects with loans up to 90-125% loan-to-value and no prepayment fees

View Fact Sheet

Construction, Tenant Improvement, & Rehabilitation Loans

Partner with our in-house construction loan experts to ensure a smooth build from start to finish

View Fact Sheet

Mini-Permanent Loans

Creative financing with up to 90% loan-to-value for mission-driven projects

View Fact Sheet

New Markets Tax Credits

Work with an experienced New Markets Tax Credit (NMTC) lender and Community Development Entity (CDE)

View Fact SheetLearn More About Our Loan Process

Momentus Capital’s Continuum of Capital

Across the Momentus Capital branded family of organizations, we offer a continuum of lending, investment, and advising solutions at every growth stage.

From small business owners to social service facility operators, we are here to support your financing and technical assistance needs.

All Loan & Service OfferingsBenefits of Working with Capital Impact Partners

Mission-Driven

We do not just measure results based on financial return, but rather by how we can address community and economic development needs in our communities.

See Opportunity, Not Risk

Where many traditional lenders may only see risk in supporting community projects, we see opportunity to create financial and social impact.

Flexible Terms & Timelines

We pride ourselves on issuing competitive loans that are also flexible and appropriately structured to fit our borrowers’ repayment abilities. This means offering financing of $500,000 and up.

Four Decades of Experience

Since 1982, we have delivered financing solutions and counsel that meet our borrowers’ individual needs and circumstances.

Support for Innovation

In addition to traditional transactions, we support innovative approaches that amplify impact, such as school-based health care centers, mobile service providers, and community centers and food hubs that serve multiple businesses.

Deep Network of Partners

To create tailored financing, we utilize our relationships with traditional financial institutions, government programs, insurance companies, pension funds, foundations, and impact investors and leverage their funds to support a range of community building projects.

Interested in Financing? Get Started Today!

Delivering Mission-driven Capital for Social Services

When communities have access to essential services, they can break the barriers to success.

As a leading nonprofit lender, we work to achieve this vision by delivering much-needed capital to key community pillars, including high-quality health centers and education facilities, healthy food retailers, mixed-use and affordable housing, cooperatives, and dignified aging facilities.

Fueling Economic Growth & Opportunities in our Communities

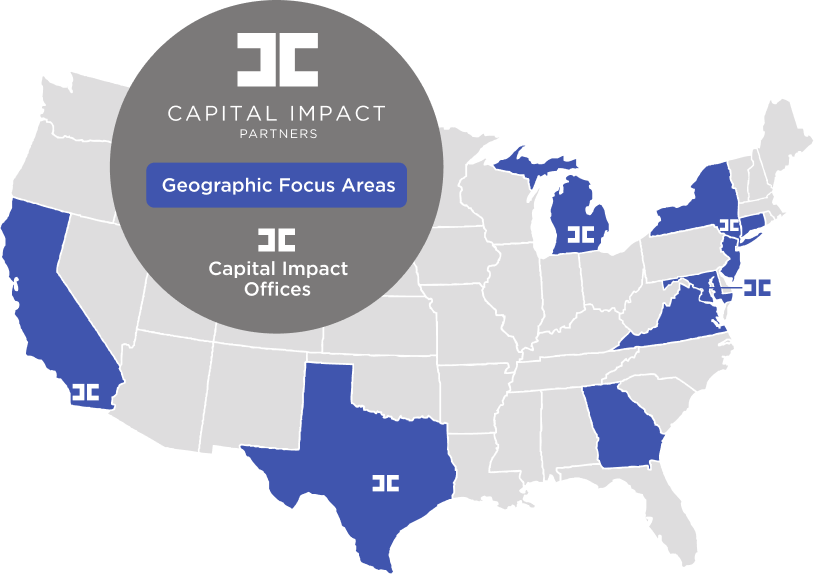

While Capital Impact finances projects nationally, we realize the importance of fostering deep connections with communities to understand their needs and work with them to create tailored solutions.

To that end, we cluster our investments in places where we have roots and are better positioned to leverage a deeper understanding of the context of our work, past investments and relationships, and market knowledge to maximize our impact.

As part of this effort, we focus our lending in specific regions, including California, Georgia, Michigan, the New York metro area, Texas, and the Washington, D.C. metro area. We do, however, encourage you to reach out if you have a high-impact project that fits within our mission outside of these areas.

Ready to start your project? Let’s Talk.

Stories of Impact

Learn More About Our Approach

A Strong History of Social & Financial Impact

A Mission-Driven Community Development Financial Institution

+

Working Since

1982

on Community and Economic Development Nationwide

=

$3+

Billion

Invested in Communities to Deliver Social Impact

A Strong History of Social & Financial Impact

A Mission-Driven Community Development Financial Institution

+

Working Since

1982

on Social and Racial Justice Issues Nationwide

=

$3+

Billion

Invested in Communities to Deliver Social Impact