Thank you for submitting your application for the CPCA COVID Response Loan Fund.

Our team plans for an expedited review and response to ensure timely disbursement of the funds. You will receive an email from a Capital Impact team member within the next few days confirming that your application is complete and ready for our review OR requesting additional information to complete the application. We expect to communicate loan approval decisions by late November and to fund all loans by the end of the year.

If you have any questions, please do not hesitate to reach out to our team by clicking the button on the right side of this screen.

Once approval decisions are made, selected borrowers will have a short timeframe to provide the documents needed to close the loan. Below is a list of key documents that will be required for closing if your loan application is approved. More details on these documents can be found in the Frequently Asked Questions.

Please plan ahead for any items that you expect to take longer than a week to obtain.

1. Board Resolutions approving the loan

2. Insurance Certificates naming CPCA Ventures as loss payee

3. Consent to Additional Debt (if required by existing lenders)

Thank you for all of your efforts to serve our most vulnerable populations!

Return to the main CPCA COVID Response Loan Fund Page here:

Follow Us

Our 1,300+ nonprofit members operate on razor-thin budgets, often relying on federal program support based on patient visits. Even as our dedicated staff stand at the front lines of the Coronavirus the number of visits qualifying for payments has plummeted, putting CHC’s across the state in financial jeopardy. The CPCA COVID Response Loan Fund is a critical stopgap measure to prevent unnecessary closures of their operations.

CPCA president & CEO

STORIES OF IMPACT

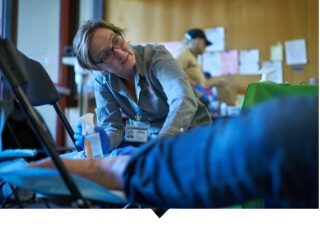

Capital Impact has a long history of supporting Federal Qualified Health Centers and Clinics throughout California. Here are just a few of those stories.

CEO Profile: Jane Garcia, La Clínica de La

Raza

For many years, Capital Impact has worked with Jane Garcia, a powerful advocate who has built one of the largest community health care systems in the United States.

Follow Jane’s hard-fought journey of Jane to create social change.

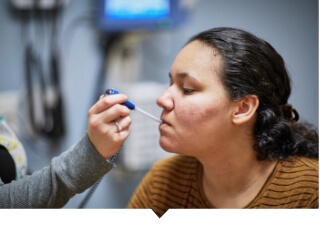

Ole Health: Bringing Health Care Into The Community

OLE Health is building the kinds of bridges that take its services on the road to meet patients where they are, creating more equitable access to quality health care.

Innovative Financing Expands Care for California’s Communities

Our support of White Memorial Community Health Center in Los Angeles is just one example of how we have collaborated with The California Endowment to find ways to better support the growth and innovation of CHCs.